Perhaps the most misunderstood financial planning instrument amongst agri-producers (and not just poultry) is…

…the ‘Balance Sheet’.

For many, it’s a myth.

A bit like the Yeti.

Tales of one-off sightings abound as hearsay and legend.

But to date, no convincing evidence nor proof of its existence.

However, today – we’re here to change that.

We’re here to capture (once and for all) to the nullifying of every shadow of doubt…

…a LIVE specimen of the poultry farming balance sheet.

But why?

For the sake of stroking our egos in vain glory in dreaming of net worth?

No.

To prove daring?

No.

But rather to learn a critically important financial lesson as an agribusiness professional, AND…

To gain vital literacy within a nuanced nook of entrepreneurship:

The merits of bootstrapping and the noble pursuit of net worth.

I came across a colourful PDF resource lately…

…an easy-on-the-eye, beginner-friendly template of a poultry farm balance sheet, produced by the Farm Beginnings Collaborative.

Now, it does a great job of shedding light on the much-maligned and misunderstood cousin of the P+L or income statement – the balance sheet.

And reveals its true nature, which runs contrary to popular belief amongst farmers (or rather ignorance) as actually being a fairer bellweather of true profitability, than mark up or margin.

Not convinced about the merits of our friend the balance sheet?

Then, all you need to do for uncontestable proof is search the front page of Google ‘on-topic’ and you’ll discover the following concurrence:

“Fundamental analysts, when valuing a company or considering an investment opportunity, normally start by examining the balance sheet. This is because the balance sheet is a snapshot of a company’s assets and liabilities at a single point in time, not spread over the course of a year such as with the income statement.” – Investopedia.com

“The balance sheet is one of the most important financial documents used for valuation purposes.” – goquantive.com

“Balance Sheet Valuation is grounded in the principle that the value of a business can be derived from its net assets.” – VFD Academy

“A balance sheet provides a succinct and well-structured display of assets and liabilities, empowering potential buyers to evaluate the overall financial health“ – Brentwood Growth

“A balance sheet is a financial statement that lists a company’s assets and liabilities. Understanding this statement is a must for every investor.” – RC Global Asset Management

…and the list truly does go on.

Believe me now?

So,

…over the next few minutes, I walk you through the Farm Beginnings Collaborative Balance Sheet Exercise (authored by Julie Kolodji, Farm Service Agency Loan Program Manager

in Minnesota) which no doubt will add some serious tangible value to your future poultry entrepreneurial wealth.

[*A quick note – the scenario illustrated below is quite simplistic, but the principles apply to any business from a backyard operation to a multi-billion dollar corporation as the quotes above testify.]

And now, let’s begin by injecting some comprehension:

11 Key Definitions

- Asset = tangible or intangible item that, if used, can generate income

- Liability = an obligation that costs money

- Current = assets expected to be converted into income within 1yr

- Intermediate = assets expected to be converted into income within 10yrs

- Long-term = assets expected to be converted into income beyond 10yrs

- Net worth = the overall result of subtracting the total cost of liabilities from the sum market value of assets

- Liquidity = how readily an asset could be converted into ‘available’ cash

- Equity = financially rooted ownership in a business

- Debt = money owed which either you or your business is obligated to pay back within a defined timeframe

- Solvency = your business’ ability to pay its financial obligations on time without delay

- Sovereignty = maintaining ownership and ultimately control over your business and capacity to enforce decisions

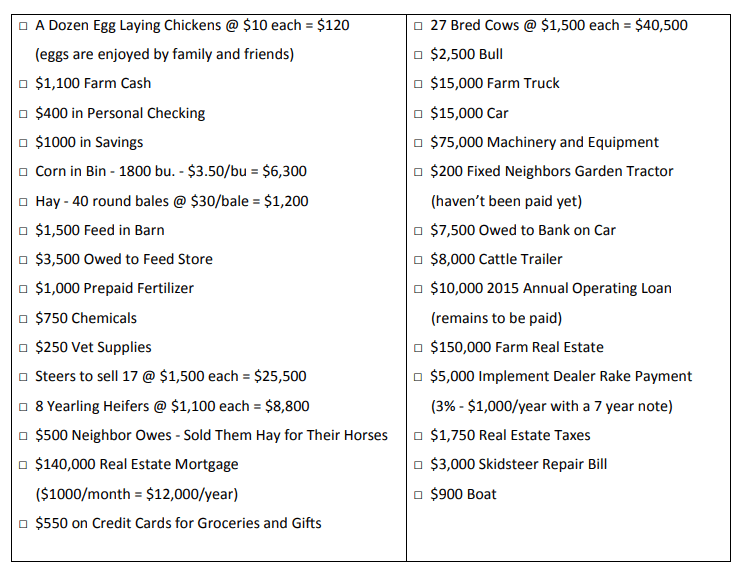

The Inventory

A veritable shopping list of items owned either outrightly by you, your farm or somewhere in between (?) in your thinking.

And it’s from this random assortment of (tangible and intangible) building blocks, that we assemble the integrity of your total net worth.

Items of notable financial consequence – both business and personal

In no particular order…

Although initially laid out in disarray, it’s now time to put all these things into a disciplined financial structure.

Enter…

The Balance Sheet.

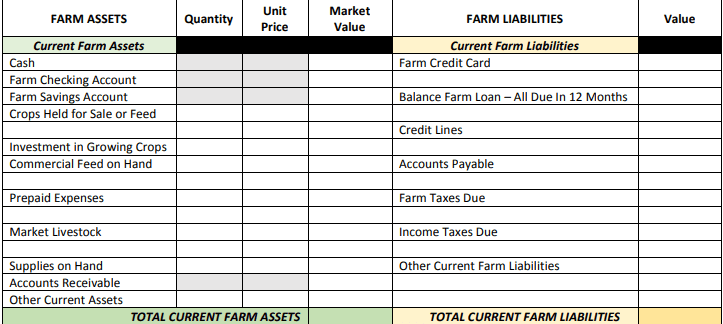

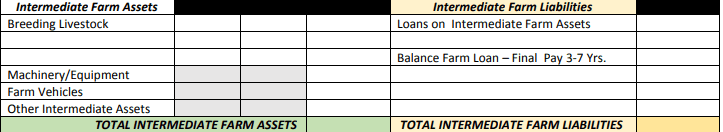

The Balance Sheet Template

1. Current farm assets vs. Current farm liabilities

Items carried by your farm, both financially binding and liberating, which impact the short-term financial timeframe.

How well-balanced is my near-term value?

I.e. If my business became unprofitable, or loss-making…what are my farm’s immediate financial obligations and could their costs be settled by selling off the items that would fetch immediate cash conversion?

- Immediate liquidity (assets that could be sold very quickly to release cash)

- Recoverable impact loss (…if I had to sell these assets, I’m pretty sure they would be quite easy to recoup when my business profits pick up again.)

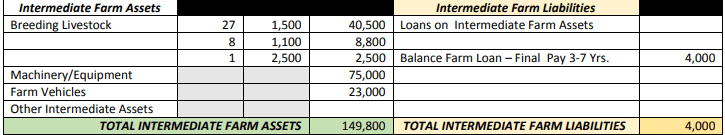

2. Intermediate farm assets vs. Intermediate farm liabilities

And now, how about my mid-term value?

I.e. If my business continued to lose money rather than make money and the value of my near-term business assets is insufficient to cover the exposure of my near-term liabilities, would the market value of my mid-term assets outweigh the expense of my mid-term financial obligations?…

- Relatively liquid (assets that could be sold quicker than larger-ticket items like real estate, but would be more difficult to turn into ready cash than say a savings account or market livestock)

- Considerable impact loss …if I had to sell these assets, it would make running my business significantly harder, plus replacing them once I regain profit, may not be so easy)

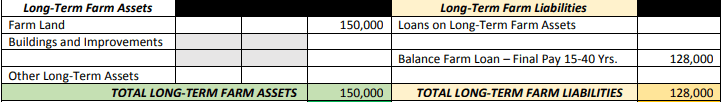

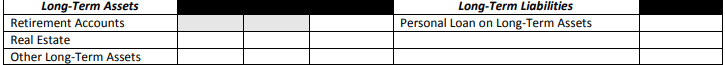

3. Long-term farm assets vs. long-term farm liabilities

And finally the long-term picture?

i.e. if my business’ profitability continued to nose dive and my business losses spiral, and I managed to sell all near-term and mid-term available capital business assets to cover their relative liabilities but I still owed money, would my largest most cumbersome business assets fetch enough market value, if sold, to meet their respective binding obligations – plus other remaining business debts?

- Relatively Illiquid (assets that would take a relatively long time to turn into ready cash from selling and that typically have sophisticated sale cycles)

- Catastrophic impact loss (…if I had to sell these assets, that would pretty much mark the end of my business)

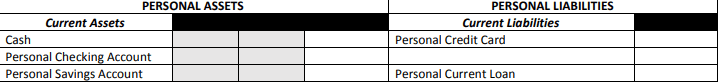

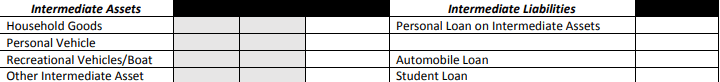

NEXT – rinse and repeat, but this time with personal assets and liabilities…

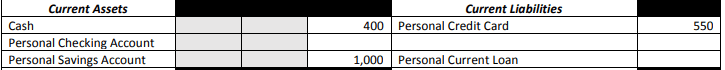

4. Current personal assets vs. current personal liabilities

- Immediate liquidity

- Recoverable impact loss

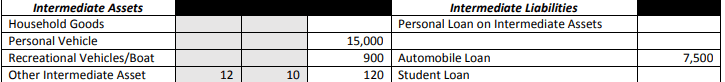

5. Intermediate personal assets vs. current personal liabilities

- Relatively liquid

- Considerable impact loss

6.Long-term personal assets vs. long-term personal liabilities

- Relatively Illiquid

- Catastrophic impact loss

Round up

It’s best to think of each of the 6 tables above as buckets with which to fill using the items in the inventory.

That said, the question that arises is:

How do you know which items to pour into which bucket?

Followed by:

What rules dictate this?

We’re going to satisfy these points a little further on from hear.

But before we delve into learning theory, let’s glance our eyes over a living example of the balance sheet above and how it work in practice.

The Balance Sheet Statement

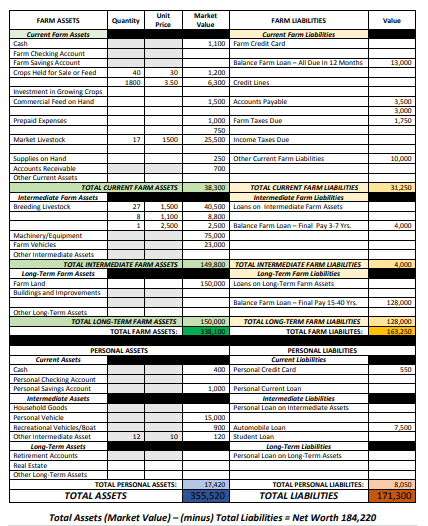

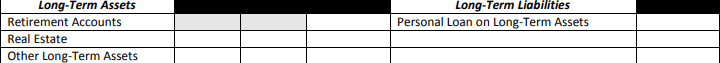

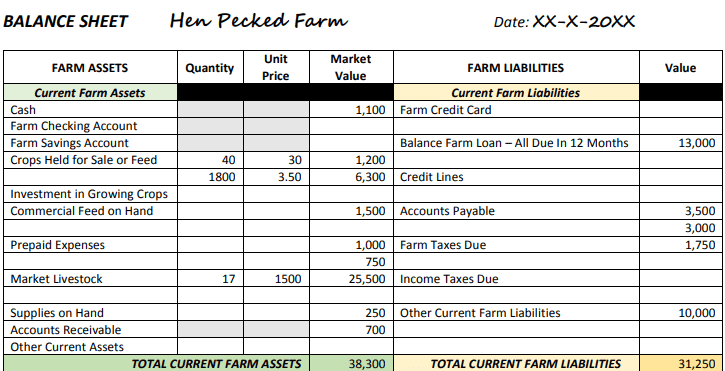

Here’s an example balance sheet for a fictitious company called, Hen Pecked Farm.

In fact, looking closely enough, you’ll identify:

a. the items (both assets and liabilities) quoted below are from the inventory that we began with.

b. the template used below is identical to those ‘buckets’ above

Scan through each section of the balance sheet below and take note of the allocation of items to asset/liability category.

If the rationale of allocation is as yet unclear – fret not. We’ll examine that in depth at the end of this analysis.

1. Current farm assets vs. Current farm liabilities

The market value of immediately liquidisable assets outweighs short-term financial obligation expenses by +$7,050.

Tight, but positive.

2. Intermediate farm assets vs. Intermediate farm liabilities

The market value of mid-term assets greatly outweighs the mid-term expenses incurred by binding financial obligations (~x37).

Largely, due to breeding livestock and machinery.

3. Long-term farm assets vs. long-term farm liabilities

A close call between the market value of farmland and outstanding loan balances to pay over the next 15-40 years. Only $22k between them, that said assets are ahead by a whisker.

4. Total farm assets vs. total farm liabilities

Total farm liabilities are 48% of total farm assets. There is a greater that 1:1 coverage here.

5. Current personal assets vs. current personal liabilities

Cash outweighs the credit card debt by almost x3.

The personal vehicle has a 2x advantage of the remaining loan balance to be paid.

There are neither long term personal assets or liabilities in this case.

6. Total personal assets vs. liabilities

Overall total personal assets cover total personal liabilities more than 1:1,

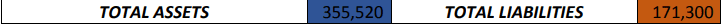

7. Total assets vs. total liabilities

The value of total assets is more than x2 total liabilities taking into account both business and personal possessions and obligations.

So, stacked against one another – the business and personal worth categorically and overall, in this case above, leaves the owner in a positive position of value.

i.e. they have a positive net worth…+$184,220.

…the value of what they OWN outweighs the cost of what they OWE.

Financially healthy.

So, under keen financial management and stewardship, the business and individual should be able to keep up to date with all their financial obligations…even if profit dwindles or even fails for a short period, there is contingency.

The Way To Think About This

The rationale behind the balance sheet is “thinking about the worst case first.”

What’s the worst that could happen?

We live in a credit-based or fiat monetary economy. Our currency is effectively an IOU that can never be cashed in.

However, our credit-based arrangements rooted in the lending and borrowing of currency, are indeed legally binding – to the result of repossession by the lender in the event of default.

Hostile legal takeover and self-declaration of financial incompetency

= Insolvency (when broken up the sale of the individual parts of a business, have not the worth to save the whole).

Think credit crunch.

Banks suffered failure due to imbalanced, balance sheets.

The confidence in fiat (“let it be”) flattened, resulting in trembling throughout all investment circles.

Governments were asked to save fiscal systems and rescue the very concept of wealth as we currently know it in this age.

And rather than release commoditised wealth i.e. gold, crops etc. – because they have none.

They printed more money.

Meanwhile, the rest of us who have no such option – lost homes, businesses and suffered personal damage – and in the worst cases, loss of life.

Balance sheet is your theoretical, dry-run insolvency acid test

The balance sheet answers the question: “Could I dig myself out if my business falls behind?”

And ultimately, this is why the balance sheet is such an important indicator of investment-worthiness to institutional lenders.

They ultimately want to know:

“…if your business operations suffer adversity, would creditors lose out? Or, could stuff be sold to bail out?”

But conversely for you, perhaps as a prudent poultry entrepreneur, you need to be thinking…

The (flip)upside

How can I use this tool of a balance sheet to my commercial benefit and purposely…

…load my business and personal ‘bags’ with value accruing or even compounding assets that grant me superior strategic leverage?

Do This Now – Run The Exercise Yourself

Try running the same balance sheet exercise yourself accounting for both personal and business assets.

Click to use my balance sheet quick calculator

If you haven’t started your business yet, take your theoretical ideal poultry enterprise set-up and lay out assets vs. liabilities.

Why do this?

- Want funding? Your lender will base their decision on this exercise.

- Want to avoid losing your business to debt? This is the tool that will steer you clear of that.

No vanity metrics – this is truly nuts and bolts.

Intrinsic value.

This in summary affects your:

- Ability to borrow, should you be inclined (although I have great reasons why you shouldn’t.)

- Current and future cash flow.

- Exposure to or risk of insolvency.

- Ability to successfully divest or exit.

And lastly, for the avoidance of all confusion from here onwards, in case you ever have difficulty in discerning the technical difference between an income statement, a balance sheet and cash flow…

…this simple phrase should clear things up:

Winds of change, sinking sand and on-demand.

Winds of change = profit and loss/income statement.

- Prices and costs go up and down exposing your business to either profit or loss in varying degrees. Yes, you can influence your position and insulate, but you can’t stop the flux.

Sinking sand = balance sheet.

- If the winds of change go against your business, is the foundation going to fail and fall through, or maintain integrity and keep you standing.

On-demand – cash flow.

- Regardless of whether I make more money than I spend, do I have enough money on hand to satisfy my obligations when I need to satisfy them?

…again:

“Winds of change, sinking sand and on-demand.”

Think of your business this way and you’ve mastered 80% of entrepreneurial financial literacy.

And Now The Upside: Introducing My Bootstrapping MasterClass & Blueprint for Poultry Entrepreneurs

Wealth retention

The gold standard for any business is to retain wealth.

Prudence…

…THE common trait found in ALL successful investors, from Warren Buffet to Alex Banayan.

From A-to-Z list – investors know how to make money…make more money.

(Losing is also, part of the game too, but the goal is to limit losses and net a profit, consistently.)

Start strong, stay strong

And a great launchpad for wealth retention in business is bootstrapping.

(DIY funding…Apple, Meta (formerly Facebook), Dell Computers, Microsoft…all these businesses were launched by bootstrapping.)

Starting with what’s to your own hand, rather than asking for someone’s hand to help.

Making optimal utility to get going.

Why so important?

Remember that balance sheet above?

The sinking sand for a business is what it owes (liability, or legally binding obligation to pay money back according to pre-determined conditions).

And contrarily, the firm foundation of a business is what it owns (asset, income generating item of intrinsic market value)…but here’s the twist, an asset could also be what a business has permission to make use of that it doesn’t own.

The fewer liabilities and more assets – the greater your net worth and the net worth of your business.

Net worth is an investment magnet.

(*People want to keep their money in a sure house.)

Sound good?

Here’s how it’s done

Are You Ready To Try My Boostrapping Masterclass & Blueprint For Poultry Entrepreneur (*With or Without Capital)?

I’ve put together this net-worth rocketing blueprint that you can easily put into action – even before you lay your 1st egg or process your first carcass. Using this blueprint you can increase your net worth and produce an investment magnet of a poultry enterprise:

🎯Download This Boostrapping Masterclass from The Poultry Library Now (Paid)

And now over to you…

- Are you currently writing a financial plan for your poultry enterprise?

- Have you run a poultry business before but incurred loss or failure?

- Are you an advisor to poultry businesses and need a framework for teaching financial literacy?

Let me know your thoughts below – I read every comment.

Leave a Reply