Are you looking for a user-friendly online net worth calculator & balance sheet template for your poultry farm business plan?

Calculating poultry farm net worth

Net worth is the result of ¹substracting the total expense of all binding financial obligations (aka short, mid and long-term liabilities) held by your poultry farm, away from the ²total current realisable market value of all assets (short, mid and long term) held by your poultry farm.

i.e. Total market value of business assets – total cost of business liabilities = Net worth.

This is a marker of intrinsic commercial value. The whole figure is the sum of the parts.

Net worth is used by investors, specifically, as a primary indicator of a business’ financial health and therefore credit worthiness.

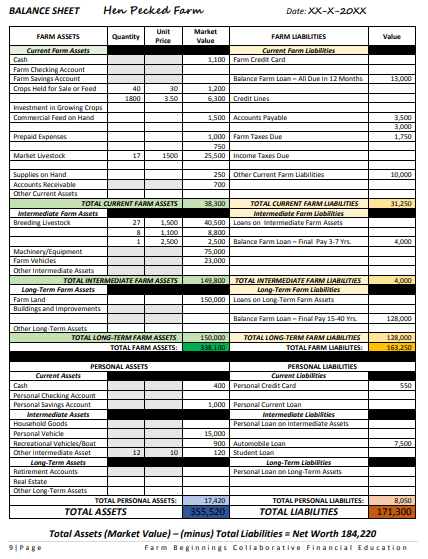

The financial instrument or template used to calculate net worth is called a balance sheet (see the image at the top right of this article, for example).

Whilst investors use the balance sheet exercise to guide investment decisions…

…poultry business owners and entrepreneurs should use the balance sheet to identify areas they could increase their net worth by bootstrapping.

The poultry farm balance sheet

The poultry farm balance sheet is a simple comparative exercise in which asset value is sized up against liability cost.

Every business should have one because the balance sheet provides an estimate of just how firm the financial foundations of your business really are.

And especially in the case of agribusinesses where economic downward pressures have been known to easily precipitate insolvency – a balance sheet provides an acid test for the avoidance of financial calamity.

Why it’s important to calculate your net worth as a poultry entrepreneur

Net worth tells you just how exposed your business and personal assets are to being repossessed should your business fortunes turn against you.

It’s therefore critical to take a glance at worst case when planning to preemptively build strategic defence against the hostility of triggering an insolvency pathway.

Methods for calculating poultry farm net worth

When calculating your net worth as a poultry entrepreneur, use one of the methods below:

1. Manual balance sheet exercise

Steps

- Pick a reputable template, like the one in this post.

- Estimate current market value for each asset (quoting the method used)

- Fill in the template for assets and liabilities.

- Calculate the trade-off in each category between asset value vs. liability cost.

- Determine a final net worth value.

2. Try The Poultry Farm New Worth Calculator & Balance Sheet Template

This method involves using a user-friendly fill-in-the-blanks form for calculating net worth using a detailed balance sheet template. Plus, this calculator is free to use and will even email you the data after each use:

Remember…

Review this article with thumbs up or thumbs down below – then fill out the feedback form.

I read every comment.

Leave a Reply