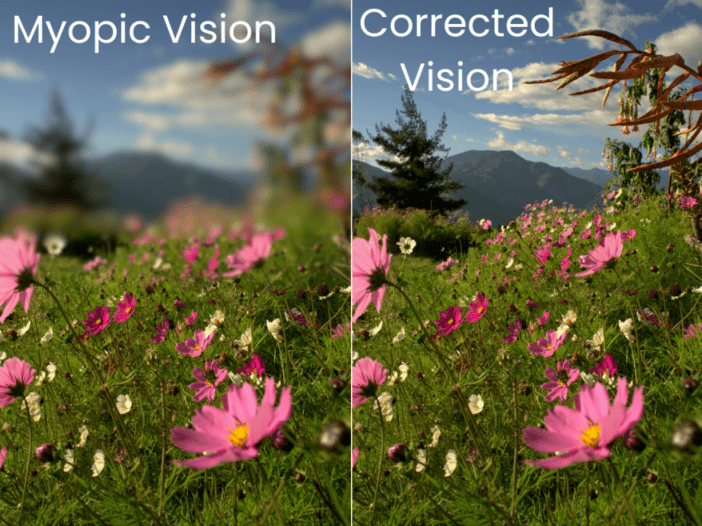

Myopia blights judgment.

And,

Nearsighted subtlety is so seductive.

How true.

(We’re headed on up to the mountain, right?

But somehow, the meadow seems so attractive right now!)

To the denial of tomorrow,

Today wants it all.

I came across an article recently that aptly illustrates the picture I would like to paint for you today.

And with no pun intended, I found it a breath of fresh rarefied air in both moral and doctrine…

…here’s a snippet:

“The first area where a poultry grower needs to invest is in the environment of the house. Creating the ideal environment for the chickens to grow in costs money. This is an investment that the grower will see only when the flock sells and he/she gets paid for raising the flock…creating the best environment will cost a little more but it will pay good dividends in the end.” – Improving ROI with ventilation (thepoultrysite.com)

Aside from food and water – the poultry house —-> the host environment – is arguably the most important (complex array of) input(s).

A controlled rearing environment provides bodily comfort whereby the feed conversion potential of the bird is duly accentuated (optimised)…

…literally safeguarding your monetary investment against adverse performance.

And then there’s the benefit of just plain ol’ cost efficiency, like with this calculated example:

“Consider the following example: Every poultry house has ventilation fans. For the sake of simplicity, we will say that every fan in the house is a 48-inch fan. The house needs a total of 12 of these fans. When pricing fans, one can expect to pay somewhere in the range of $800 for a galvanised prop exhaust fan on the low end to as much as $1,400 on the high end with a fiberglass prop exhaust fan. If you are buying 12 fans per house and you are building six new houses, there is a difference of $43,200 between buying a low-end fan and a premium fan. One would be tempted to go with the low-end purchase; however, when looking at the CFM per watt, the premium fan will pay for itself and create a significantly lower cost in electrical costs for the life of the fan, thus increasing one’s long-term profits…when you are looking at equipment, think long term and efficient in order to make a good investment.” – Improving ROI with ventilation (thepoultrysite.com)

The classic trade-off between money spent now paying you back in the future…vs. money saved now to latter detriment.

The former, being the investment mindset.

And it’s not just accepting deferred returns on money that grants forward advantage, but time investment also.

Admittedly, one of the most frustrating pursuits is ploughing away your efforts into something that doesn’t afford you the immediate satisfaction of being filled or quenched.

In other words, sacrificing your time to do something that doesn’t thank you for it soon enough.

But in such cases, sobriety would suggest that every harvest is worth waiting for eventually.

Sow now, reap later…whilst patiently waiting out the interim.

On the day of recompense – who can deny you the months or perhaps years of holding out?

It becomes yours, by default.

That’s how I see the payback on poultry farm ownership.

You’re building a system.

The benefit provided by this system is the establishment of a profitable agribusiness that naturally accrues asset value (whilst steadily building revenue along the way).

Whilst this philosophy doesn’t prohibit the owner from ‘milking the flock’ for sustenance, the true value-benefit of ‘asset value’ is only realised upon exit, or an equity trade (breaking up i.e. divi-dend).

In other words, the net worth of your poultry farm (balance sheet asset) PLUS future earning potential (discounted cash flows) to a potential investor or buyer = $$$$$$$$$$$+, is far greater than the current value of your eggs or meat (P+L sales revenue) to a wholesale/retail customer or consumer = $.

Remember: a standard yardstick used to arrive at a market valuation for most small-to-medium-sized businesses including – yes, poultry farms – is the TTM Revenue multiple.

This simply involves multiplying your business’s trailing twelve-month revenue by a figure known as a valuation multiple.

In the case of poultry farming, that multiple by a broad brush stroke is said to be in the region of 10x.

That’s 10x the value back as the selling asset holder, for every 1 pound/dollar/rupee/shilling/rand etc. gained by trading (plus the privilege of earnings throughout your tenure).

So, hands down…

Dominion trumps trade.

Ownership beats bank.

“As you can see, ROI is not just a business term that is restricted to Wall Street. At the end of the day, every poultry grower needs to weigh the cost and benefits of investing wisely now and reaping the rewards for months and years down the road.” – Improving ROI with ventilation (thepoultrysite.com)

My advice?

Play long.

Poultrypreneurs invest. Never spend.

Stay focused on your ascent to that distant peak of success,

Keep up the pace and look onward, don’t let the meadow slow you down.

Do this now…

In 7-steps, list your poultry project’s most valued capital assets

- Find and curate a variety of businesses for sale listings via brokers and marketplaces.

- Examine the value drivers of the deals.

- Understand the rationale behind each component of the value proposition.

- Identify who each value proposition speaks loudest to.

- Segment poultry farm owners by type.

- Consider how you might load your poultry enterprise with such value as to appeal to the most appropriate prospective buyer segment.

- Count the cost and potential valuation benefit of each driver/asset.

*By doing this, you are building a valuable evidenced-based knowledge bank of:

- What raises the intrinsic market value of poultry farms (both broiler and layer farms)?

- What type of poultry investor will value which assets most?

The result:

A successful exit strategy for getting maximum value on the sale of your poultry farm in the future, should you divest.

Are You Ready To Try My Own 7-Step

Strategy Sequence For Yourself?

I’ve put together this fortune-finding sequence that you can use with – Claude or ChatGPT, plus Google Search Operators – to generate this capital asset-boosting strategy for your own poultry business.

Here’s how it works:

🎯Download This Strategy Sequence from The Poultry Library Now (Paid)

Now over to you…

Are you currently weighing up the capital expenses of your poultry farm?

Have you had previous poultry business engagements and failed?

Have you a string of successes under your belt?

Either way, I’d be interested to hear from you.

Leave me a comment below.

I read every one.

Speak soon, Temi.

Leave a Reply