What is the current situation and status of poultry industry in your country?

If you were to start your poultry business today…

…would you be aware of what your peers are experiencing?

Before taking a long journey outdoors, or going on a camping trip – you’d want to know the weather report, right?

The same should be the case when planning a poultry business.

You should know what the current environmental conditions are and what your ship is likely to face.

In your favour or otherwise, as the pilot, you should want to be prepared for the elements ahead.

The format of this part or your poultry business plan is a summary.

Listed points and short descriptive paragraphs with quotations should be your staple structure here.

A poultry market report synopsis is the best example of what it should read like.

Example

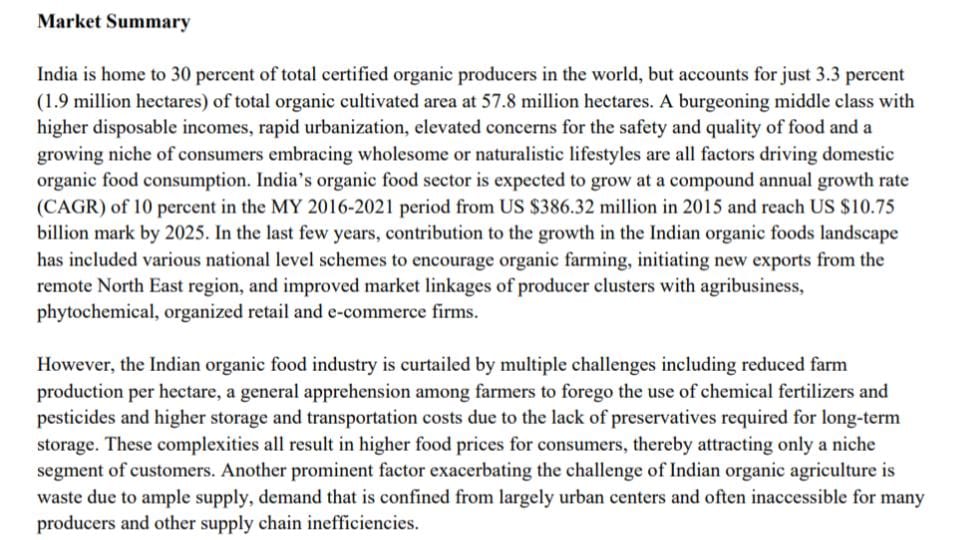

Market summary

Take this example from the USDA, you can confidently use it as a template for how a market summary on the poultry industry ought to be.

(Source: USDA India’s Poultry Industry Report)

It’s basically a compilation of the report highlights.

Line-by-line touching upon the expanded subsections of what you read later.

Production capacity

Let’s return to our case study of Senthilvela’s start-up organic poultry farm in Tamil Nadu.

What is the current estimated organic farm production of India?

“India’s MY 2018-19 organic area accounted for 1.08 percent of total agricultural land and reached 1.93 million hectares, an 8.8 percent increase from 2017 (Figure 1).

This excludes 1.49 million hectares for wild harvest collection.

The states of Madhya Pradesh, Rajasthan, Maharashtra and Uttar Pradesh have the largest area with organic certification [for export].” (Source: USDA India’s Poultry Industry Report)

“In total, India has over 5 Lakh (500,000) organic farmers.” (Source: FiBL)

And what about Tamil Nadu?

“Tamil Nadu has 12,675 hectares of land certified under organic farming (0.7% of India’s total organic agricultural land). At present, there are 10,000 farmers who practice organic farming. Many of them are, however, functioning without certification.” (Source: DTNEXT)

Tamil Nadu (TN) contributes 0.7% of India’s total organic land capacity and 2% of India’s organic farmers.

Clearly not all of this is dedicated to livestock nor indeed poultry.

But this gives you an idea of the proportion of the organic produce market vs. the total agricultural market in India.

Size and trends

What about the spending power driving the organic produce market in India?

“For MY 2020, total market size for organic packaged food and beverages in India is estimated at $77 million, making it the 30th largest market in the world by value…leading companies have lost market share to fairly smaller enterprises.” (Source: USDA India’s Poultry Industry Report)

(Source: iMarc)

India now by estimation has the 30th largest organic produce trade by market value.

But where is the domestic demand coming from?

“A growing demographic of young, educated individuals that are increasingly concerned about chemicals and pesticide residue in food products will further grow demand and domestic consumption of organic products…”

“Relatively newer trends in organic retailing, such as the emergence of specialty organic stores catering to high income neighbourhoods in metropolitan cities…”

“…curated artisan organic menus in select hotels and restaurants will continue to be a strong demand driver.”

“…social media channels via influencers, brand engagements and unique product placements (on Instagram, Facebook, etc.)”

(Source: USDA India’s Poultry Industry Report)

“Due to the surge of smart-phone usage India, coupled with low-cost internet, there has been an increase in access to information about organic food.

Added with this, e-commerce platforms acted like a facilitator reaching out to potential customers across the country.”

(Source: Food NDTV)

What does the ‘word on the ground’ say about this?

“Toddy tapper and farmer Yadiah, from Mall village in Telangana says,

We raise country chicken for our own consumption.

Of late, however, visitors from the city who come for toddy have been requesting dishes made with it.

Hence we are rearing them for food and some for commercial consumption.”

(Source: The Hindu)

This confirms it.

Country caterers like our example above, Yadiah, are experiencing a demand uplift from city folk seeking native breed chicken dishes.

Policy & domestic support

Domestically, there is no regulatory framework in place for organic certification.

India’s export standards for organic produce regulated under the National Programme for Organic Production (NPOP) – which meet EU regulated criteria – also carries official government backed labelling under the name, ‘India Organic’.

“The Government of India maintains the voluntary national logo “India Organic,” which is used by exporters, processors and manufacturers.

The certification is carried out by a third-party inspection agency under the NSOP (National Standards for Organic Production (NSOP), which are based on the International Federation Of Organic Agriculture Movements (IFOAM) basic standards.

There are no organisations representing the private organic sector in India.” (Source: USDA India’s Poultry Industry Report)

Another source cites that the retail price disparity between conventionally farmed goods vs. organically farmed is more pronounced:

“…primarily because of the [value] gaps in the regulatory framework for organic products in India.

Although FSSAI has come out with the ‘Jaivik Bharat’ framework.

In addition to the procedural challenges on certification and quality assurance, the increasing costs of inputs and the elongated conversion period from conventional to organic farming are a few of the key challenges faced by the producers, most of whom are small or marginal farmers.”

(Source: SME Futures)

As of 2011, India, however, has laid on what is known as the Participatory Guarantee System (PGS).

It’s basically a peer review system for organic farmers.

A sort of DIY (or decentralized i.e. not directly government executed) organic authentication or policing system where it is the participating farmers themselves that examine each other’s operations and practices.

The standards are a replica of the export standards and its application is supervised by the Department of Agriculture under the National Project on Organic Farming.

This domestic scheme also carries a logo to signify approved produce between local farmers and their trade partners.

The PGS logo:

(Source: USDA India’s Poultry Industry Report)

Other Government backed schemes promoting the marketing of organically farmed produce are (with links to scheme credentials):

- Paramparagat Krishi Vikas Yojana (PKVY)

- National Project on Organic Farming (NPOF)

- National Mission for Sustainable Agriculture (NMSA)

- Rashtriya Krishi Vikas Yojana (RKVY)

- National Food Security Mission (NFSM)

- National Horticulture Mission (NHM) and Horticulture Mission for North East and Himalayan State

Export trade

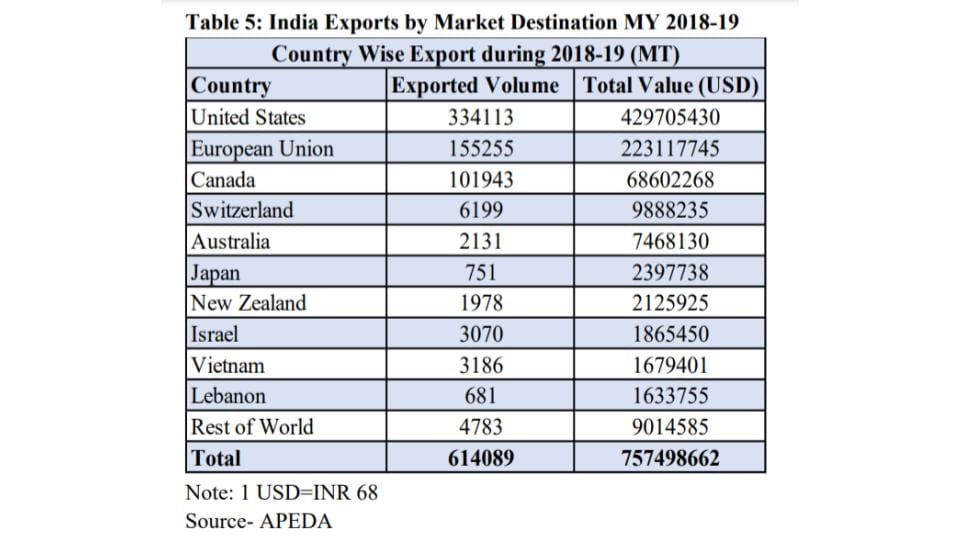

According to India’s Agricultural and Processed Food Products Export Development Authority (

Breakdown of India’s organic produce exports in 2018-19:

(Source: USDA India’s Poultry Industry Report, however data source is APEDA as stated above.)

As of 2020, there are no standards for organic certification for foods imported into India.

However, on the occasion that organic produce is imported into India for the purpose of processing to be exported to another country – U.S. organic standards (i.e. NOP standards) apply on import.

Prospects

The organic market is still an ’emerging’ trend in India.

It still belongs to a relatively small ‘conscious’ segment of consumer who are see the value of organically produced foods being worth the investment in the long term.

Government support makes this sector an attractive trade prospect for entrepreneurial venture.

Advantages

Growing consumer awareness to the socio-ecological and economic benefits is opening the demand of India’s organic produce market.

The trend is gaining traction with residents in Tier I, II and III cities alike.

Imported products are growing in numbers on the shelves in general retail stores and specialist outlets.

Competition in the hospitality and institutional sector is promoting the curation of locally sourced menus and guests/patrons are buying in.

Problems & challenges

One of the challenges is clearing up the domestic consumer awareness over verified organically farmed produce.

Authenticity is still a bit obscure.

“Due to the lack of awareness on certifications, consumers are confused about the money they are paying is for the authentic product or not as the prices of the organic products are a bit on the higher side,” says Ashar of Pascati Chocolates.

(Source: SME Futures)

Also, the attitude of producers towards converting to organic practices could do with encouraging.

This study gives insight into how producers see the prospect of becoming organic farmers:

“…40 farmers from both organic and conventional systems were interviewed. The findings indicated that conventional producers identified production and marketing barriers as the main constraints to adopting organic farming, while the age and education of the farmer were not deemed a problem.

Lack of knowledge and lack of institutional support were other barriers to conversion.

Some farmers were, however, interested in converting to organic farming in the near future in Madhya Pradesh due to the low cost of production, and in Tamil Nadu and Uttarakhand due to the price premium and health benefits.”

(Source: JSTOR)

What does all of this say of our case study subject, Senthilvela?

He’s on to a good business it seems.

All of the commercial indicators seem to be in his favour: demand, growth, low barriers to entry, premium price, low competition, desire for more variety of product…

Plus, producers generally think that organic conversion might be worth it if there was more knowledge and support.

This plays into Senthilvela’s plans to develop a cooperative farming outfit, providing training and input to his partners.

No doubt his organic trade experience and growing marketing expertise will be a draw for coop prospects.

All in all, it looks good for Nirmala Nature Farm (NNF).