Hello,

Funding your poultry farm has got to be right now the no.1 query about the whole start-up process.

And you’re right to prioritize setting a start-up budget for your new poultry business.

Starting a poultry farm is an investment and therefore it will need some personal input from you.

Some ‘skin in the game’.

For many beginners…

…their immediate thoughts take them to loans and government subsidies.

But these financial instruments carry considerable personal risk.

In this chapter,

I want to demystify how poultry loans, investments, subsidies, grants really work and how to accurately calculate their risk.

What is a poultry farming loan?

Let’s define the word ‘loan’:

“A loan is money, property or other material goods that is given to another party in exchange for future repayment of the loan value amount along with interest or other finance charges.” – Investopedia

So,

A poultry farm loan is:

Either money, land or equipment given by a lender in advance of starting your business.

Here are the terms…

In receiving the loan, you are agreeing (under the force of law) to repay the lender the entire value borrowed, plus interest (and associated fees).

Interest, fees and repayments are scheduled, by date.

Often, a borrower will be obliged to set up a direct debit or standing order (automatic bank payments) to offer confidence to the lender.

What is a Poultry Farming Subsidy?

Here’s the official definition of the word subsidy:

“Subsidy is a transfer of money from the government to an entity. It leads to a fall in the price of the subsidised product.” – Investopedia

So in the context of poultry farming…

A subsidy is when your government encourages agri-entrepreneurs to start poultry farms.

This is done by offering a financial incentive to acquire a bank loan.

In other words,

Your government want to make your poultry loan repayments cheaper for you.

How poultry loans work

You make a promise with a private lender or investor to take enough money to start your poultry farm and pay them back for:

- the sum of money borrowed (principal sum), and;

- the benefit of borrowing the money (interest/usury)

…according to schedule.

It’s all linked to timings. Stay with schedule and you’re just fine.

However, turn up late and that’s where the problems occur.

*One critical note to add:

Poultry loans are typically secured against the ownership/possession of land.

That is to say…

Your promise to pay back the money you borrowed is ‘made sure’ (or guaranteed).

This is underlined by a contractual clause.

Within this clause, you that give up the right to possession of the land, equipment and livestock, should you default.

Said simpler,

Can’t repay or pay repeatedly late?

Then hand over the ownership of your land to the lender.

And if the value borrowed exceeds the recouped costs of assets…

…then your personal belongings are next in the firing line.

A very real & personal, material risk.

How poultry farming subsidies and grants actually work

Subsidies and grants as we just said are the government’s way of making your loans cheaper.

You might say they are discounts.

They’re like shopping vouchers.

Vouchers make things cheaper that you were going to buy anyway.

But to receive a voucher from the issuer, you have to qualify.

Only then can you benefit from the discount.

(There are rules involved. Not everybody can get them.)

Why do governments give out subsidies and grants?

It’s actually good business for governments to subsidise loans for poultry farms.

Why?

Because:

- More people take out loans (Banks are happy.)

- Borrowing money is cheaper (People are happy.)

- More business and economic growth (Governments are happy.)

Here’s more…

Why banks enjoy government poultry loan subsidies

The goal of a bank is to increase its promissory hold on material assets.

What I mean is:

The aim of a bank is to hold other people’s stuff for them.

Whilst holding it, the bank uses your stuff by trading it to get financial gain.

(But most of the value of your stuff is insured if they mess up. But when widespread calamity occurs then the wildfire of a ‘credit crunch’ occurs a la 2008-9.)

When things work out though, the bank gets gains.

And substantial too.

Some of the gains it makes back is paid to you (interest).

This is your reward for sharing your stuff with them.

However, the MAJORITY of gains gotten, the bank rewards its owners, investors and workers with.

And then, of course, the bank also pays the government in taxes.

But what about when things go wrong?

Well, there are times (as I said) the bank messes up. Their trades (bets) make losses and not profits.

If this happens and they are unable to recover, then…

News gets out.

And naturally, you’ll want your stuff back (a run on the bank).

But if the bank can’t give you back your stuff, they appeal to the government.

(This is where things get nervous.)

If the government turns its back, the bank’s lenders (yes, that’s right – even banks have lenders) swoop in (and by the force of law) take all that remains in their hands of your stuff.

The bank has suffered a rupture.

In a word: bankruptcy.

Now, what if your poultry farm still depends on getting more finance from your bank?

Not possible.

But how will your business may not be able to pay its bills?

Get inventive – and quick.

Or, you could ALSO find yourself bankrupt.

(Losing your land, poultry equipment and poultry livestock.)

Again, lending carries MASSIVE risk.

This is why it is better to start with what you have, rather than what you don’t have.

Why governments enjoy government poultry loan subsidies

Governments carry public ‘money reserves’ called budgets.

And much like banks, governments get their budgets from us. The general public.

But on this occasion, in the form of taxes.

And also, just like banks, the government trades your ‘stuff’ (taxes) on funding projects for us all.

If the government projects succeed, the government:

- rewards banks to lend to you

- rewards you with more credit to borrow, improved civil services & reduced tariffs (in some cases)

- rewards itself, its private investors (national banks) and its workers

This makes it more feasible for people to borrow the money (get loans) & to get stuff done.

(Like starting up your poultry farm.)

But likewise, this also widens the financial gap between those who qualify for borrowing vs. those who don’t.

(And this only gets wider each day the economy thrives on borrowed funds.)

Why we SHOULDN’T enjoy loans, subsidies or grants?

To answer this question, we should ask…

“What would things look like without borrowing?”

Well, it’s quite simple, really.

People would learn to make the most of what they already have.

And where you would otherwise borrow the money to plug in a gap,

Instead…you now work around the problem by collaboration…

Perhaps, working with a neighbour to share in the labour and rewards of a new project, for example.

Far better for the economy.

More people working, less inflation, cheaper goods, no debt.

Us…

…solving our own problems together.

But where does all of this leave you and your poultry farm idea?

Really, it leaves you with a serious decision to make.

Again, I don’t know where you are in your planning,

Nor, what you have in your hand to start, but…

When you consider the detail above,

You see that whilst banks and governments are desperate to give away their money,

We ask 2 questions:

- Is it worth taking?

…AND…

2. Do we really need it?

The value of money

Think about all that you’ve just read.

The conclusion – in a nutshell?

Banks, investors and governments are the only ones who sell money.

We buy money.

If they hold on to money – they lose.

And we THINK that if we hold onto their money – we win.

But for us, the opposite is actually true.

Why (& how)?

One word:

Inflation.

Every day, around the world – in EVERY country the value of money decreases.

Why?

Because prices keep increasing.

The astounding loss of value within a single generation

Take this as an example:

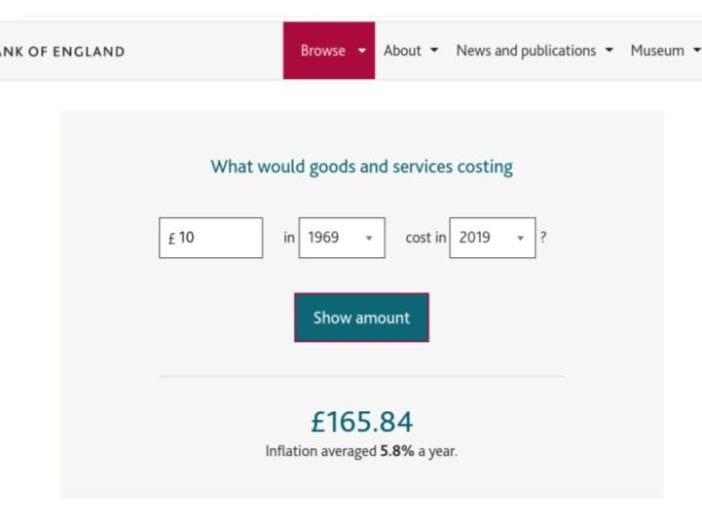

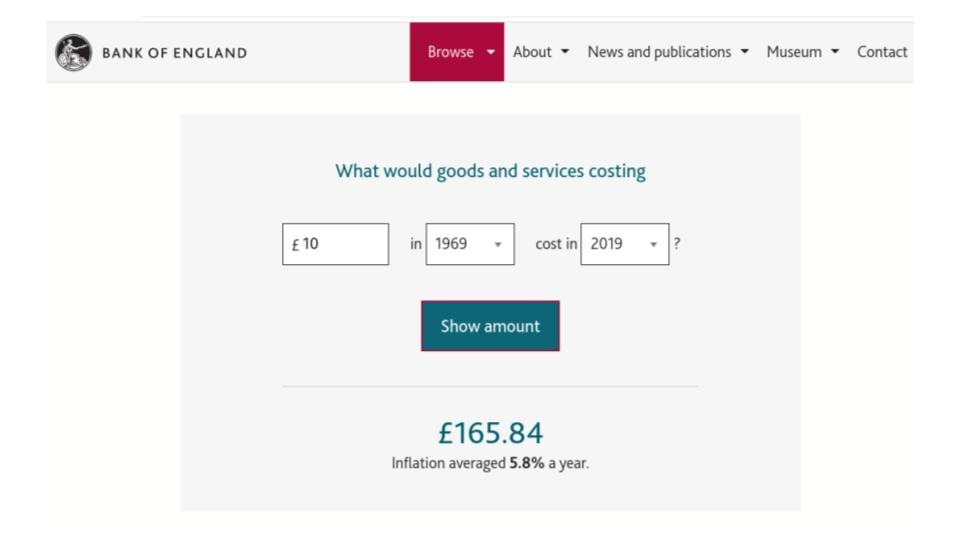

According to The Bank of England’s inflation calculator, the value of £10 today would have been wortha around £165.84 fifty years ago.

That’s a whopping 16,500% loss of value. And ONLY within the lifetime of many of us.

(What in the world is going on here?!!)

The KEY is in the small print.

Take a second look at the image above.

Did you read the line that sits beneath the amount “£165.84”?

In case you missed it: “Inflation averaged 5.8% a year.“

That small (almost significant) grain of detail is the GREAT CAUSE of this catastrophic loss.

INFLATION.

But what is inflation and what causes it?

Inflation, simply put, is the cost of living going up.

But WHY does the cost of living keep going up?

Because of two core global problems with mankind.

- Credit-based economy (A.K.A accrual)

- Supply and demand theory

Combined they produce devastating results.

Here’s how and why…

What is a credit-based economy?

Credit economy is where men agree that the value of money is based on people qualifying to get credit (or to borrow.)

So, in other words,

You are rich if you qualify for credit (i.e. having others lend to you).

This way of thinking became popularised in the 19th century.

Today, all global economies work this way.

But they didn’t always.

The alternative?

The gold standard.

What is the gold standard?

Gold standard says the value of money is based on how much gold the possessor of the money has deposited with the issuer of the money.

In plain English:

It’s an IOU.

This is how trading under the gold standard would work:

Your poultry farm can either sell eggs and/or meat in exchange for goods,

But in most cases, it would be gold.

So, you use the goods received by exchange (barter);

And you deposit the gold you receive with a bank.

When the bank receives your gold, it gives you a note.

This note acknowledges your deposit of gold with them by measure of weight.

The note also carries a signed promise from the bank.

In this note, the bank promises to pay you back the weight of gold you deposited, whenever you ready to redeem it.

When you withdraw the gold and have it back in your possession,

Then, you are able to trade the value of it on the market for goods or services.

And gold, of course, is rightly valued highly for its natural rarity, appearance and treasure.

So, that is what life under the gold standard would look like.

But what about this supply and demand theory mentioned above.

What is ‘supply and demand’ theory?

‘Supply and demand’ teaches that when there is increased supply for something than the demand…

…then the price should go down.

But where there is decreased supply for something relative to the demand…

…then the price should go up.

This yo-yo of up…down…up…down…which plagues our commercial markets is called price elasticity.

Just think of a bungee cord.

And because of this theory and its effects, vendors are persuaded to spend all their efforts and time thinking about whether their prices SHOULD go up or go down.

Why manipulate prices?

To influence buyers to buy more (AND preserve a consistent profit margin.)

They think like this:

Last week 500 people bought my eggs at $1,

And this week 650 bought my eggs.

‘Supply and demand theory’ tells me that I should raise my prices because there is more demand for my supply.

I’ll now charge $1.80 and blame the cost of inflation.

This practice is called revenue management.

But that example is buying and selling eggs.

What about if we were like the banks, buying a selling credit instead of eggs?

The effect on money when we buy and banks sell credit…

Well, if nations print money on the basis of gold deposits, then:

Then the value of money and its volume (amount) in circulation directly represents the amount of excess trade value of the country’s citizens.

In other words,

What gold doesn’t get used immediately to buy food, clothing or housing – gets deposited with the bank.

When the citizens prosper – so does the bank’s holdings.

Plus, there will be many promissory notes out in circulation too.

i.e. there will be lots of ‘money’ floating around.

But just think about this:

What if the value and volume (amount) of promissory notes or money in circulation had no link to the value of gold on deposit, but it itself is traded as if it were gold?

Then, this is the credit-based economic system that we have today.

Strange, huh?

And with it are 2 fundamental questions:

- Who stole our gold?

…and more importantly than that…

- Who stole the value of all our labour (sweat) that we exchanged for the gold?

You see in truth, holding money should be the bank’s debt to pay us back gold.

But somehow, we’ve accepted the switch that it should be our debt to pay back the bank.

A very subtle steal. (What a crime…)

And the disease (or cause) of this is poverty and the disinheritance of generations to come has come through:

INFLATION.

We’re killing ourselves with this. It’s making us desolate.

Any we have no excuse.

Because now we know better.

(Right?)

The root of inflation?

The answer is buried in a new equation that we just learned.

Recap:

Supply and demand x The credit economy = Inflation Creation

Multiply these 2 terrible teachings together and what you get is…

…a runaway, (un)natural catastrophe called inflation.

A financial wildfire of deception, which devastates nations and leaves everything and everyone in its path in ashes.

It’s time to get out of the way of inflation.

It’s time to leave the credit.

It’s time to go back to gold.

Quick economics of starting a small scale poultry farm

Now, let’s return to the example of that £10 fifty years ago…

Put in perspective for your personal situation,

Just think about the difference in the market value your home would have had 50 years ago, for example.

(Again, only a fraction of its price today.)

And now to put that into the context of your poultry farm:

The cost to start your poultry farm 50 years ago, would only be a fraction of what it costs you to start the same farm today.

So,

Let’s get this straight:

If the cost of borrowing (buying) money to start your poultry business today is 16,500% more expensive than it was only 50 years ago…

And the cost of buying an egg or chicken is 332.94% more expensive today than it was 50 years ago…

And if things continue to go the same way over the next 50 years (and you pass on your poultry business to the next generation),

Then, your children would have inherited a staggering 16,167% loss (disinheritance) from you.

(Plus the risk of losing their family home should they default to pay back).

A TERRIBLE DEAL.

And all because of misunderstanding the small print.

5.8% interest on a loan application sounds like nothing today.

But in actual fact, you would lose 16,500% in 50 years by inflation alone.

Add to that the 5.8% cost of borrowing (loan interest) to the equation too,

And you’ve actually then lost 33,000% value in 50 years. And you would have passed that ‘hangover’ on to your children too.

An unforgivable deed having read this article today.

(Especially for the sake of the next generation.)

No wonder poverty in each of our countries is so-so crippling. And for so many.

…caused by nothing more than the greed of us all who want to qualify to get more, despite so many having much less.

Perhaps that sounds like a tough line to take.

But true.

And actually when you line the facts up against your personal ambitions for starting a poultry business,

You probably find that your intentions were quite different from the effects of inflation above.

No doubt you had the following in mind:

- making a sustainable income without debt

- taking advantage of a low-cost startup agribusiness

- offering accessible labour for unskilled people

- providing poor communities with affordable, quality food

- helping your neighbour to start small scale production in their communities

- keeping a clear conscience

- HELPING US ALL STAY DEBT-FREE

- (& killing inflation)

So, this lesson teaches us if we don’t judge correctly…

…we can actually achieve the opposite of what we intended.

What are the next steps?

Start to think differently about money.

Borrow to start your poultry farm and lose 33,000% within your lifetime (compounded for the next generation).

Instead:

- Start your farm as a zero-debt startup.

- Use proven techniques for exponentially scaling your agribusiness NATURALLY.

- Grow through value production (without playing yo-yo with prices).

- Totally outstrip inflation.

Don’t I need CAPITAL to start up a poultry farm?

Yes and no.

Sure, you need SOMETHING to start.

But if you begin to address that point by accepting that what you’ve got is ALL you’ve got…

Then, you leave yourself with no choice but to be witty and inventive in order to make up the difference in what you can’t buy.

Bridge the gap with smarts.

And in the following post, I’ll show you some proven ways how.

Leave a Reply