This is a complete guide to broiler farming.

Any country, any breed, any model…written just for you.

So if you want to: [Read more…] about Broiler Farming: The Definitive Guide (2020)

Last updated on by Temi Cole 13 Comments

This is a complete guide to broiler farming.

Any country, any breed, any model…written just for you.

So if you want to: [Read more…] about Broiler Farming: The Definitive Guide (2020)

Last updated on by Temi Cole 6 Comments

New to farming layer chicken?

Ever thought what it would be like to follow a new layer farmer taking his first steps?

This article was written for you.

It’s a detailed illustration taking you through the operational highlights.

Just the basics, step by step:

Fast.

[Read more…] about Layer Chicken: 72 Weeks In The Life Of A Layer Hen Farmer

Last updated on by Temi Cole 6 Comments

Need expert advice on the best poultry feed formulation?

[Looking to make your own homemade chicken feed?:)]

If you want to know how making your own formula:

…then this is the guide for you (+ there’s an example formula at the bottom!).

Enjoy.

[Read more…] about Poultry Feed Formulation: Nutrition & Homemade Methods (Layer/Broiler)

Last updated on by Temi Cole 12 Comments

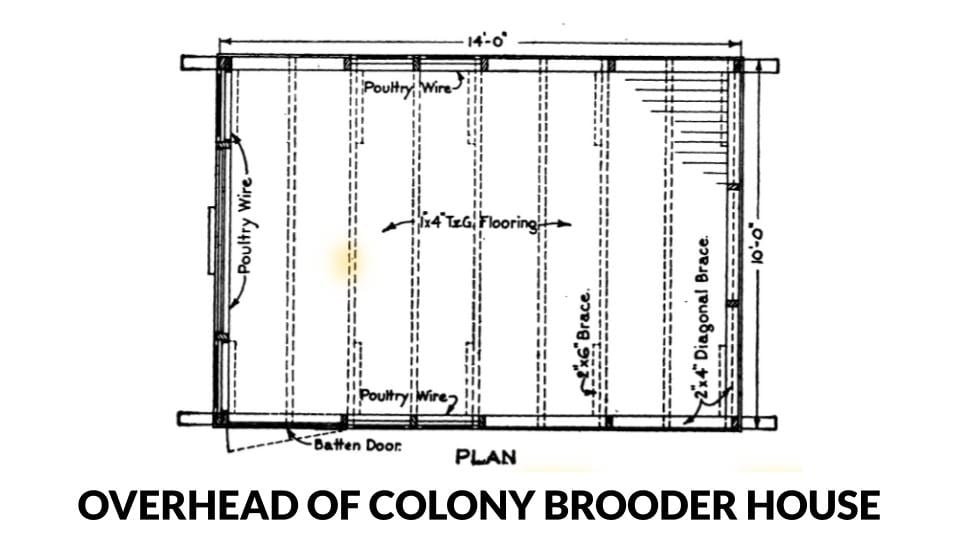

You might already know that there are literally endless poultry house designs, structures, systems and sizes…

But, what exactly are they? (All a bit of a maze, especially if you’re a poultry farming beginner).

Well, I’ve saved you HOURS in rooting around the net because I’ve put together a complete list.

Some are old and traditional.

Others are built using more modern techniques.

Others are innovative & experimental.

But I’ve got them all right here. And I made sure this list is up-to-date for 2022.

Let’s get started.

Definition:

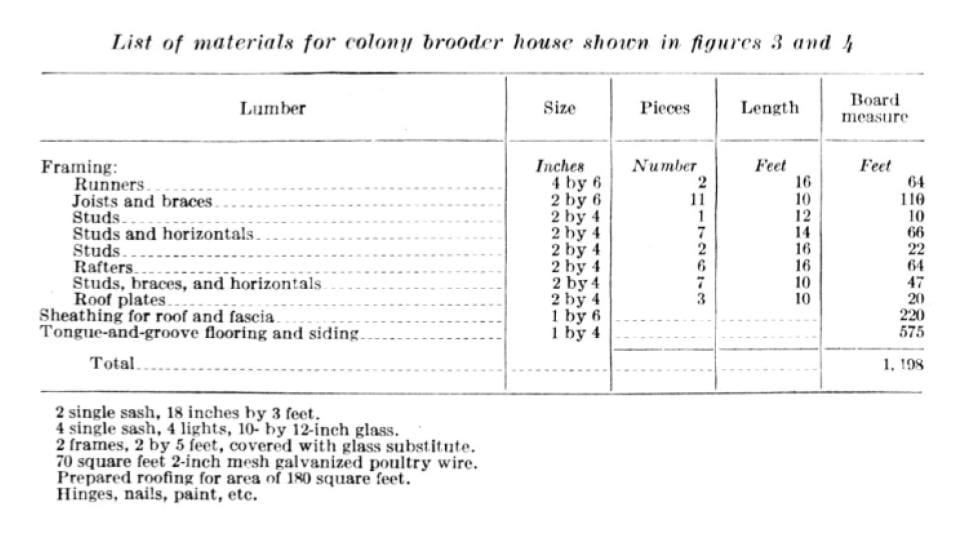

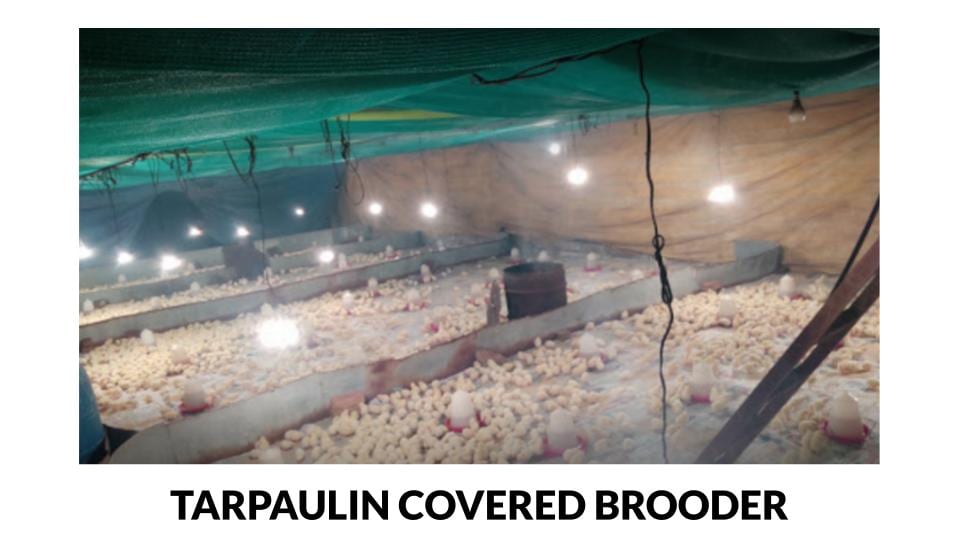

Brooder houses are houses for chicks of a day-old and upward.

The first 7 days of care are the most critical days to get right when projecting the performance of broiler or layer chicken.

Definition:

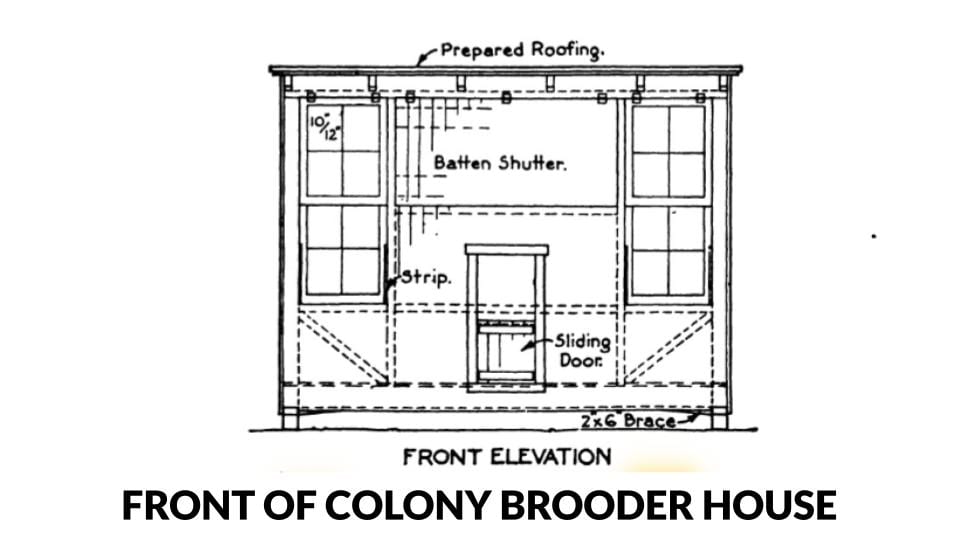

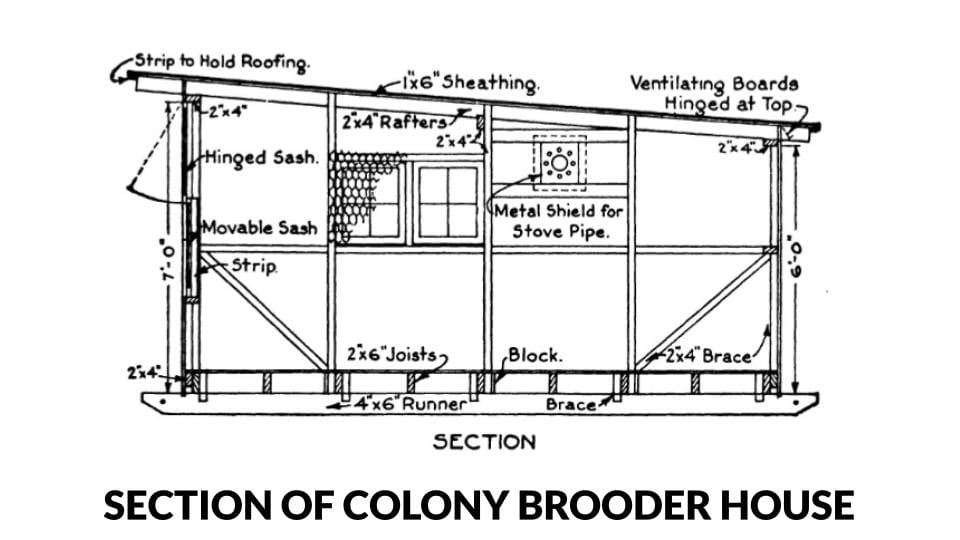

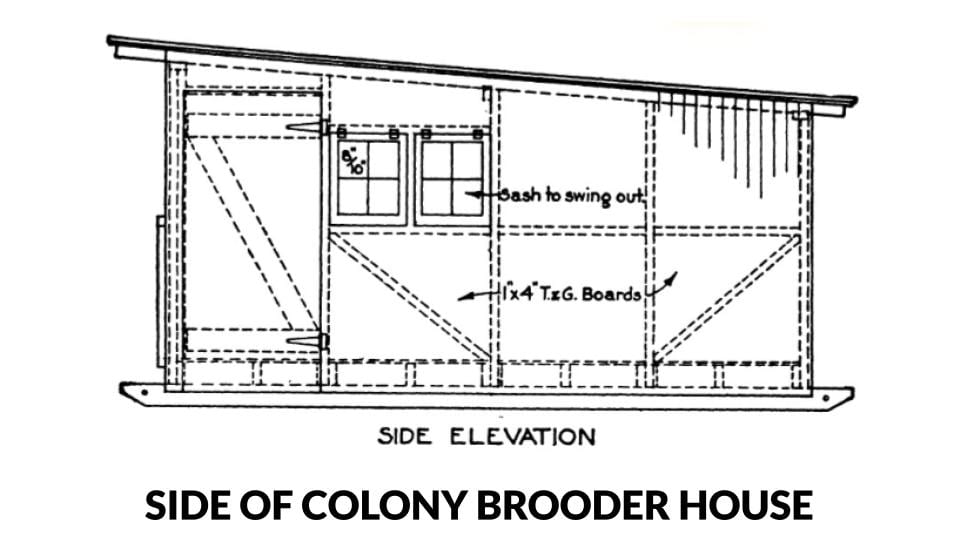

A portable house for brooder chicks.

An alternative to colony-style brooder houses, more robust for winter brooding.

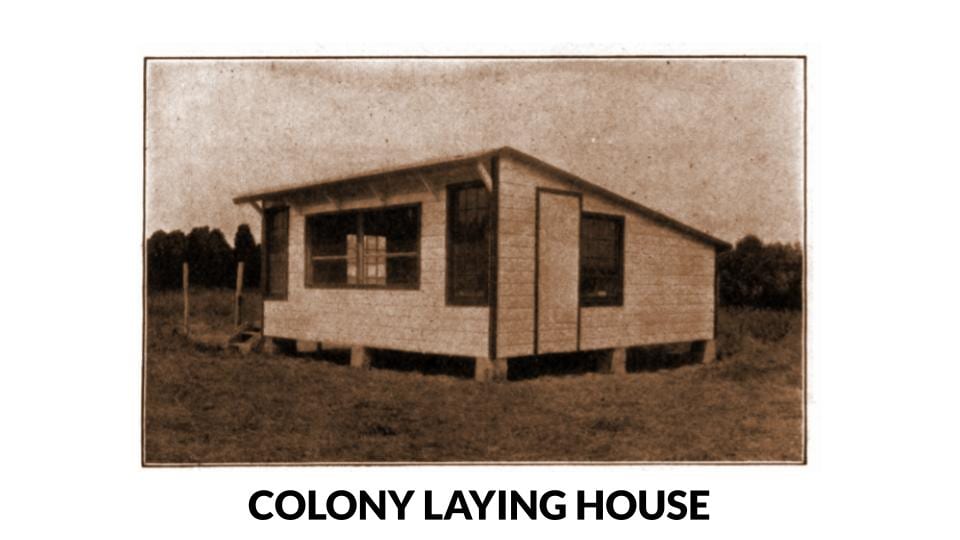

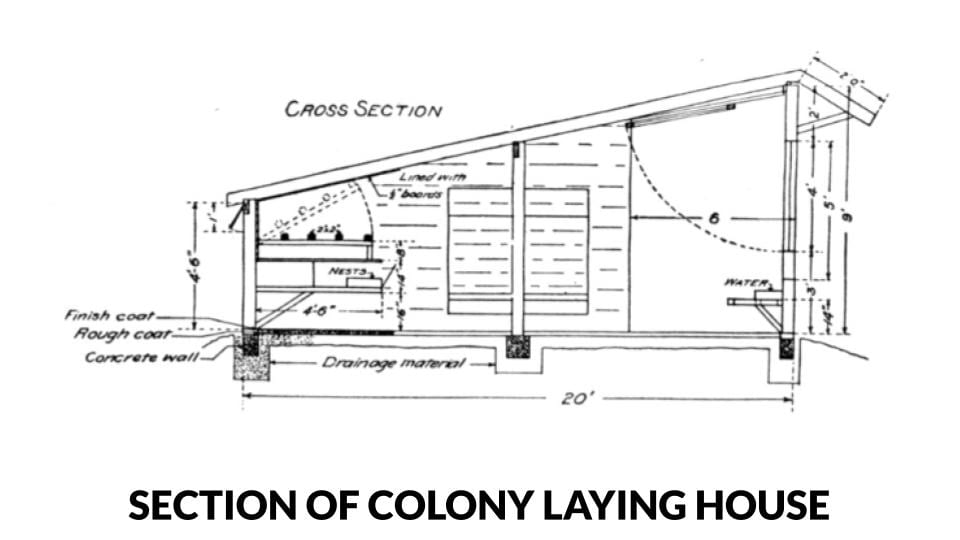

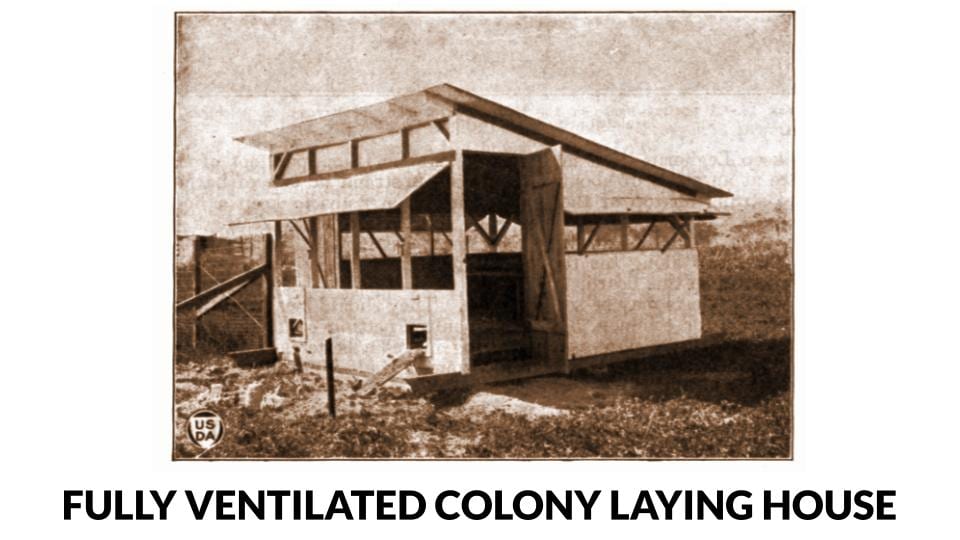

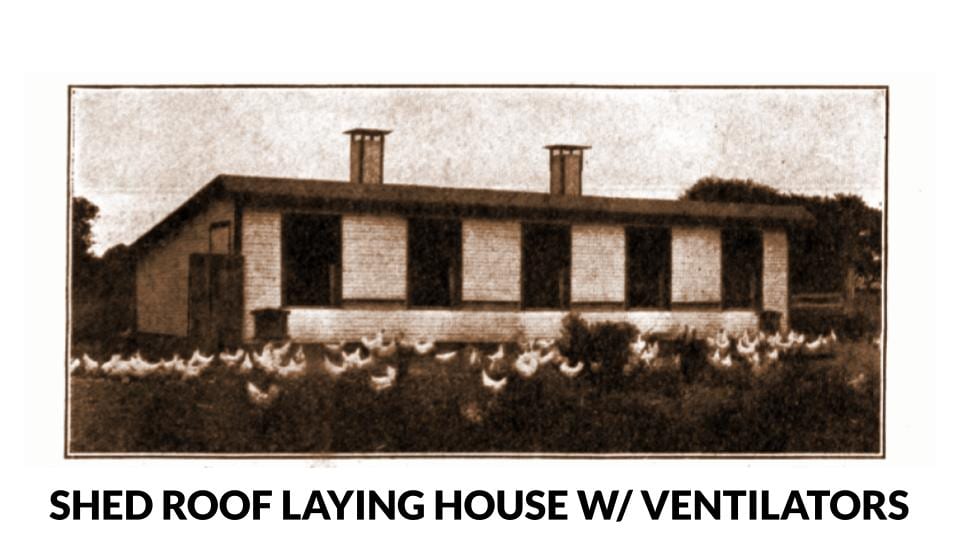

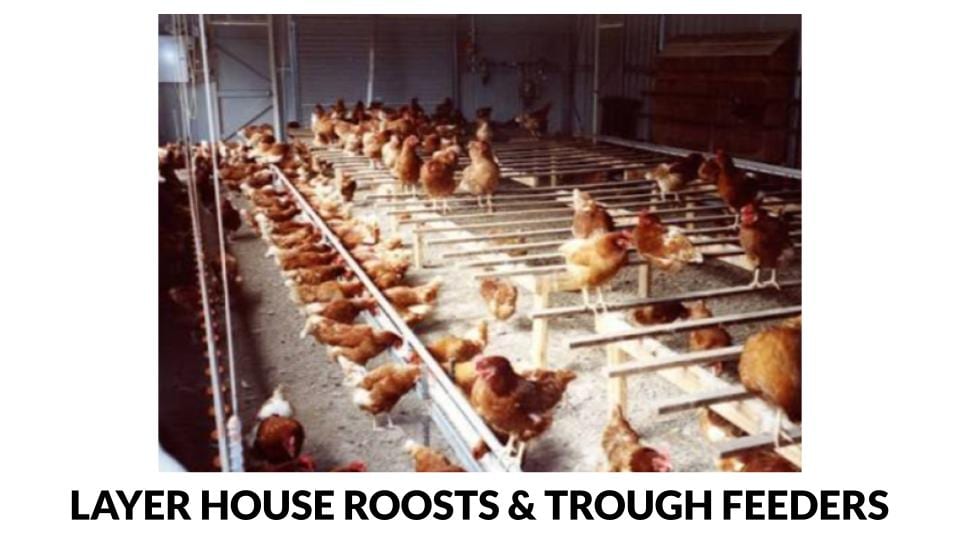

Purpose made houses for your laying flocks throughout their productive lives.

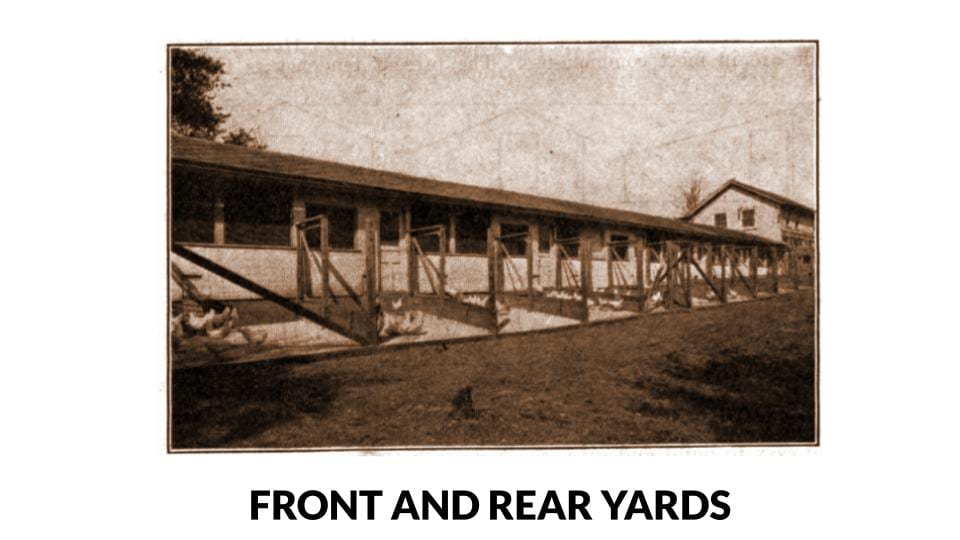

This is the outdoor space surrounding the poultry houses that must be secured and is sometimes offered to birds as range.

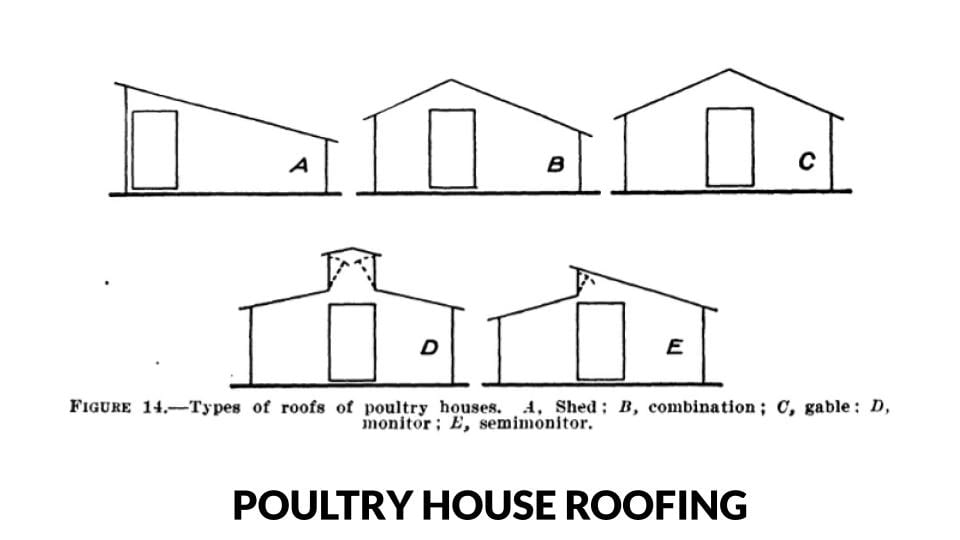

Waterproof covering with ventilation benefits for all-weather protection of flocks.

The poultry house often is built with outdoor access both to the front and rear of the house.

Poultry house flooring for birds, labourers and general ease of maintenance and cleanliness.

Dividing up the poultry house space into smaller compartments for better environmental control

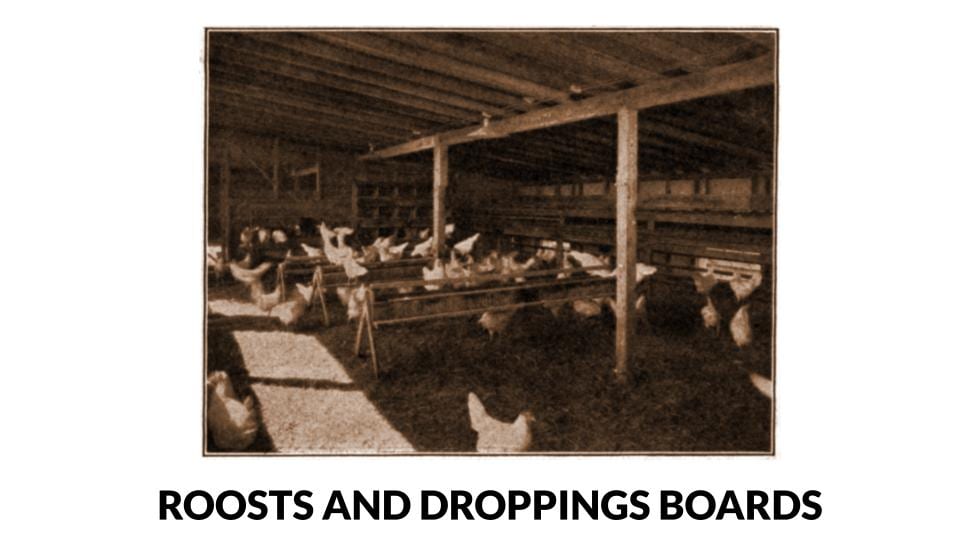

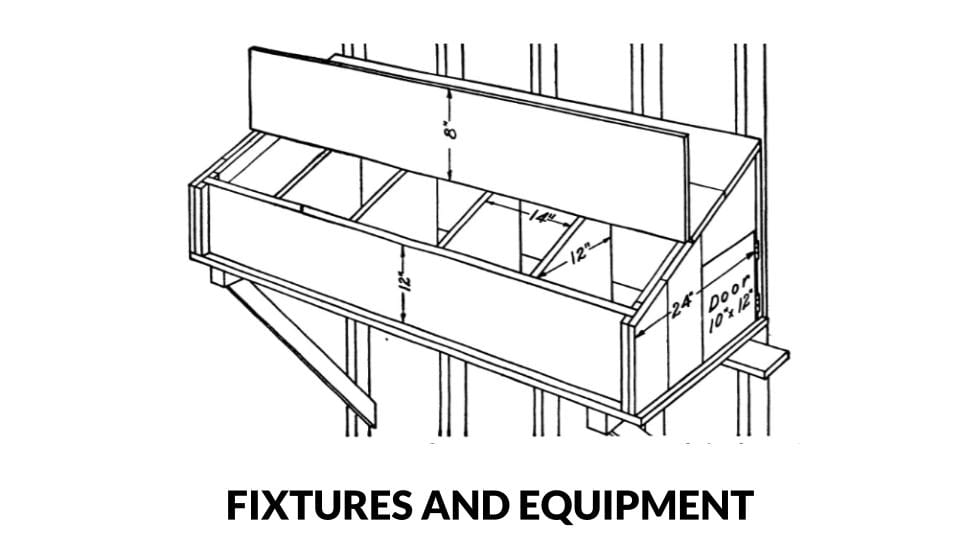

Internal fixtures and fittings of the birdhouses that encourage natural behaviour and collect droppings

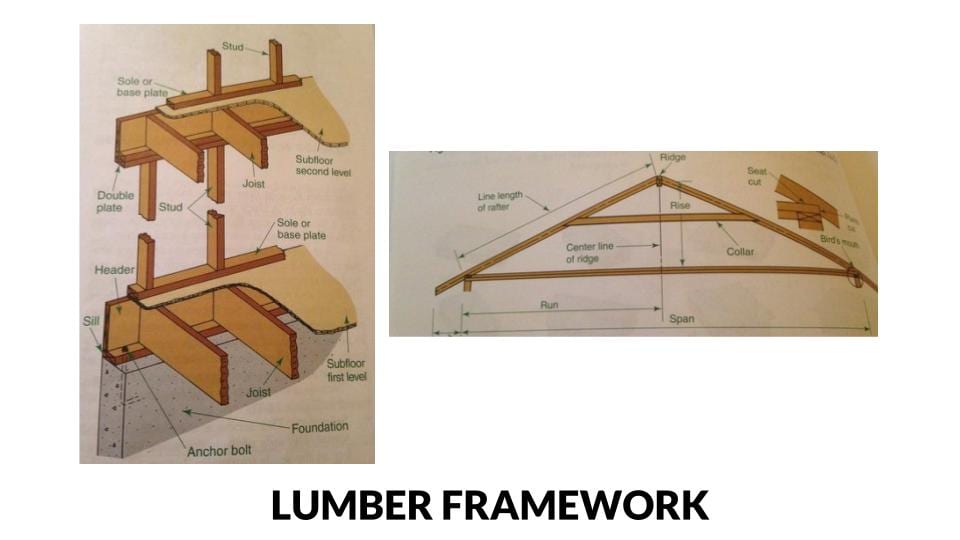

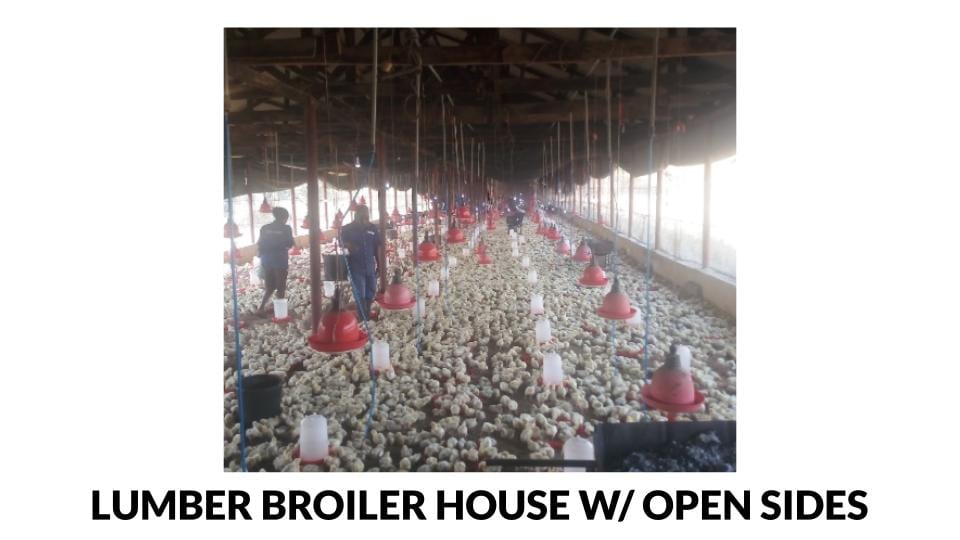

Commonly accessible materials for building poultry houses with an affordable budget.

Structural orientation of the poultry house and the assembly of its parts for best results.

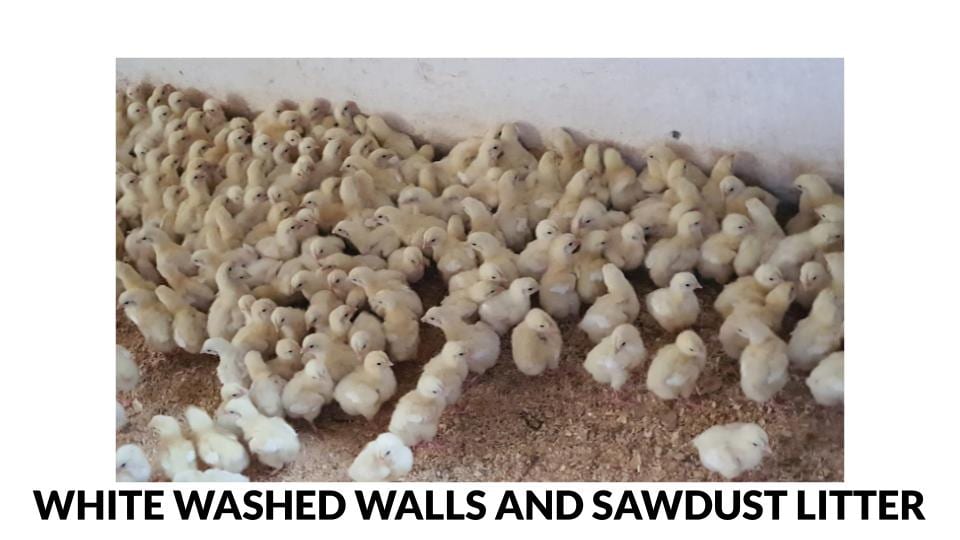

Type of alternative flooring for the poultry house – materials and designs for differing circumstances.

Upright structures for upholding the integrity of the building.

Weatherproof, thermal efficient roofing design for poultry houses.

A covering for the inside and outside of poultry houses giving a clean, hygienic and crisp finish.

Artificial lights are required to compensate for the lack of natural light in darker, winter months.

Power-generated heating for the correct running of flock management including watering and normal usage of the entire floor space

An additional layer that traps heat (reduces heat loss) laterally and vertically.

Planned airflow system for the poultry house, helping flock obtain good quality of air aiding performance.

Nests, hoppers and drinkers – anything that would be provided to enable normal bird behaviour and facilitate performance.

Small, comfortable niches where hens can rest, lay and sleep.

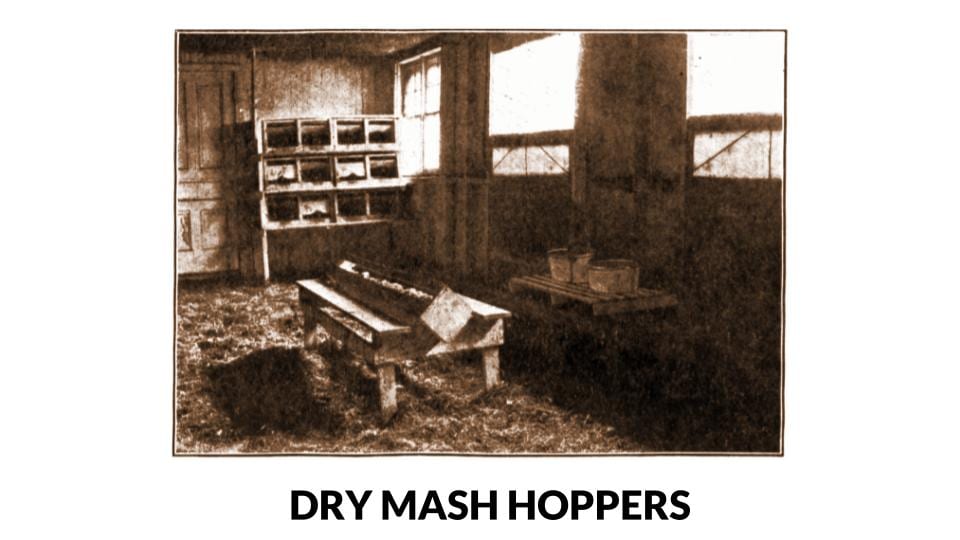

Eating containers for birds to gather and economically receive their feed.

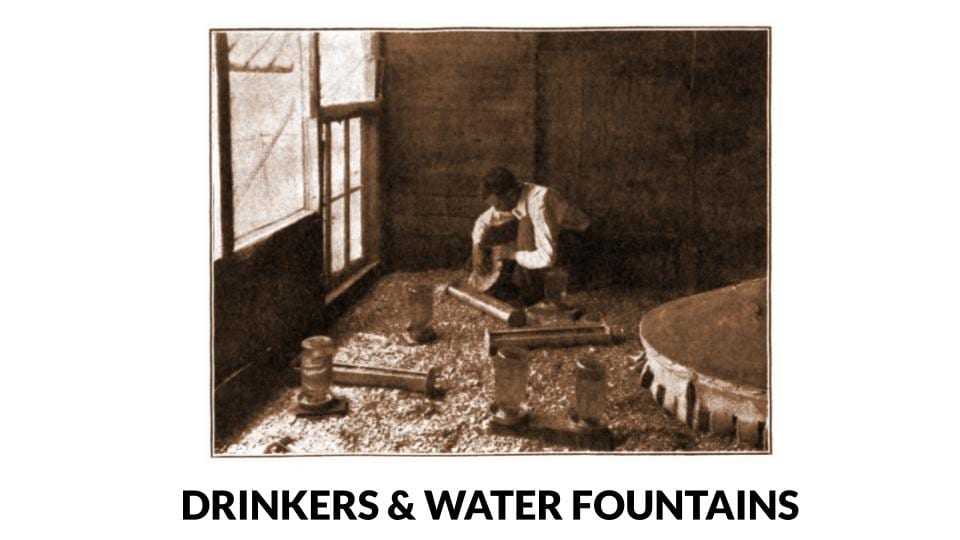

Drinking apparatus for birds to gather around and get refreshed.

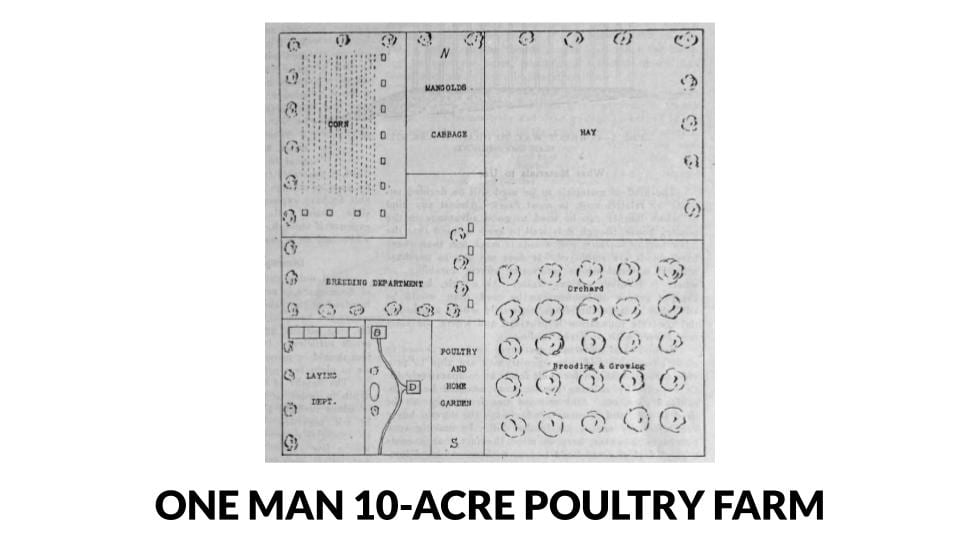

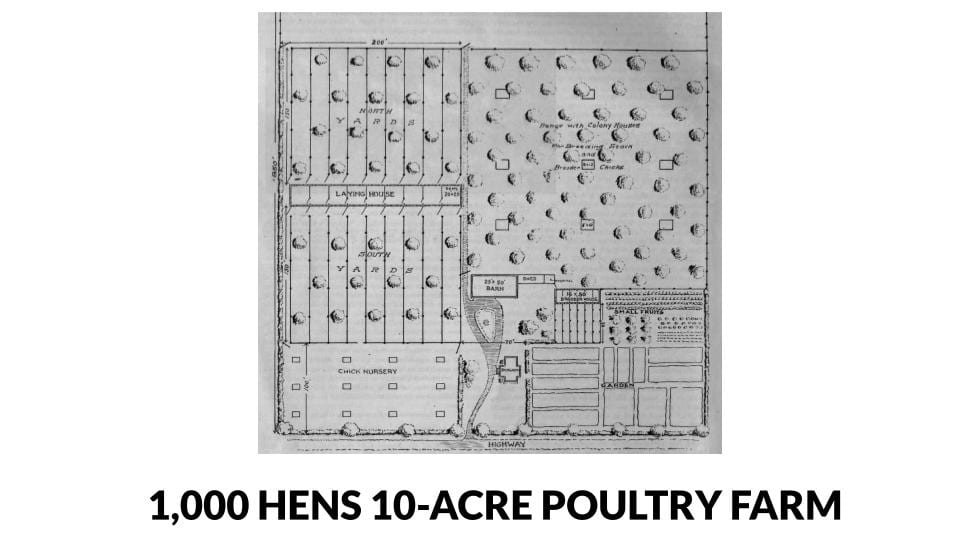

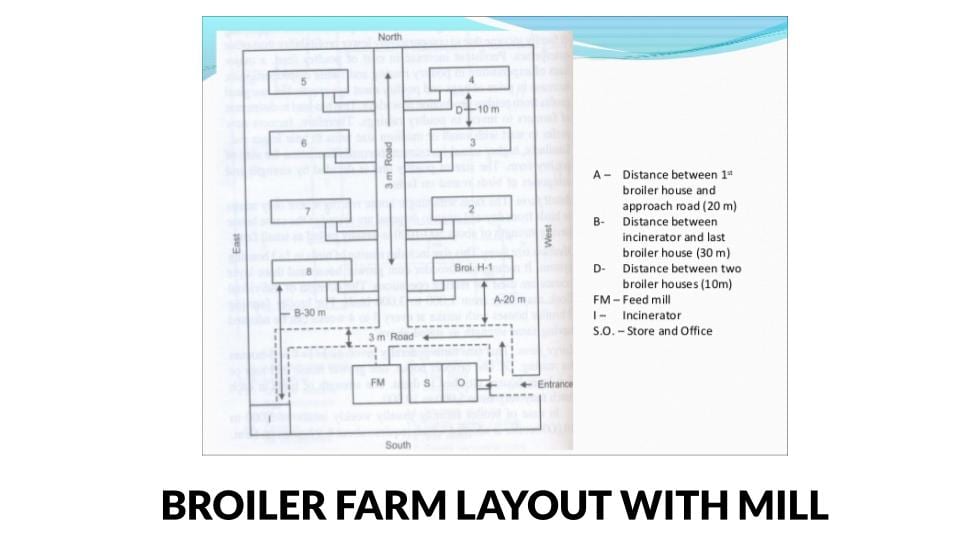

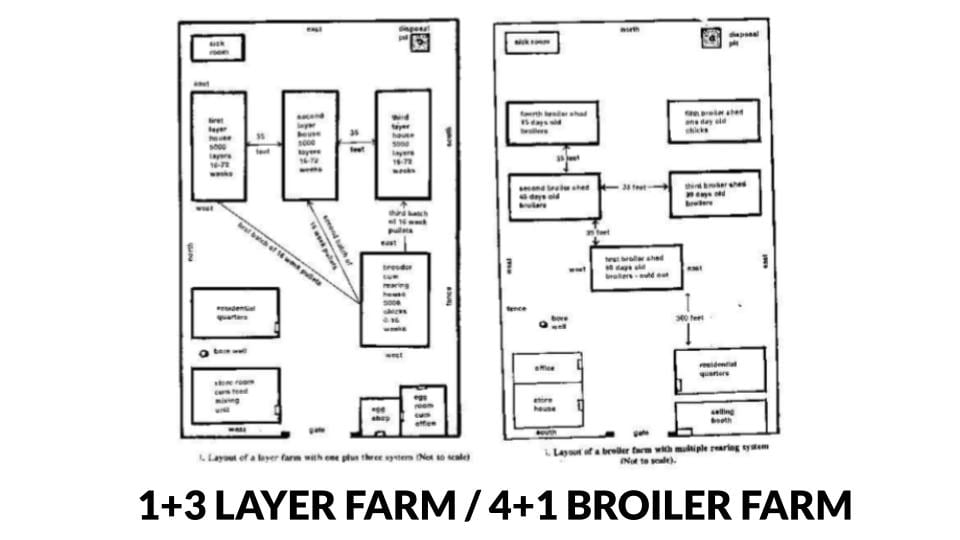

These are just some of the practically useful poultry farm layout examples on the internet.

I pulled them together for your viewing pleasure and benefit, so to speak.

Now, you might have landed on this post looking for something a little more technological.

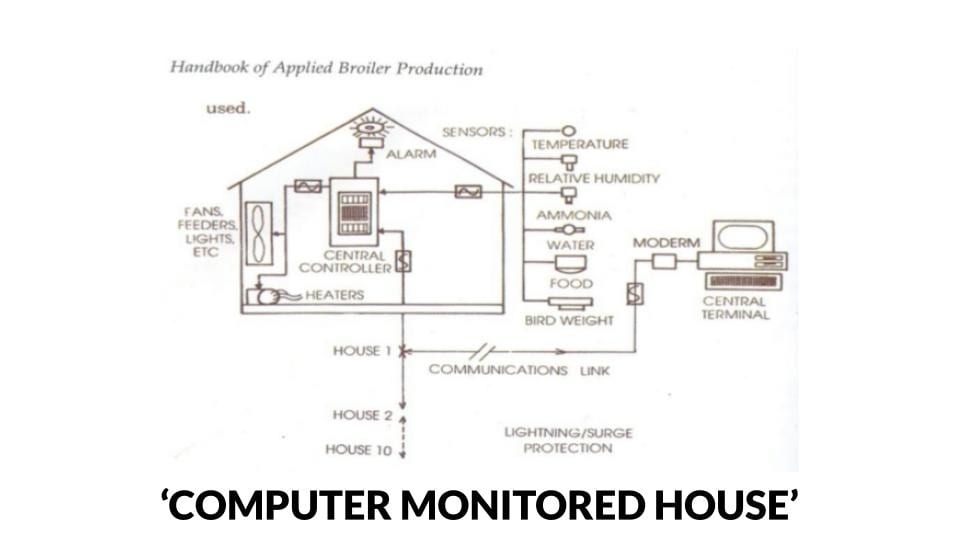

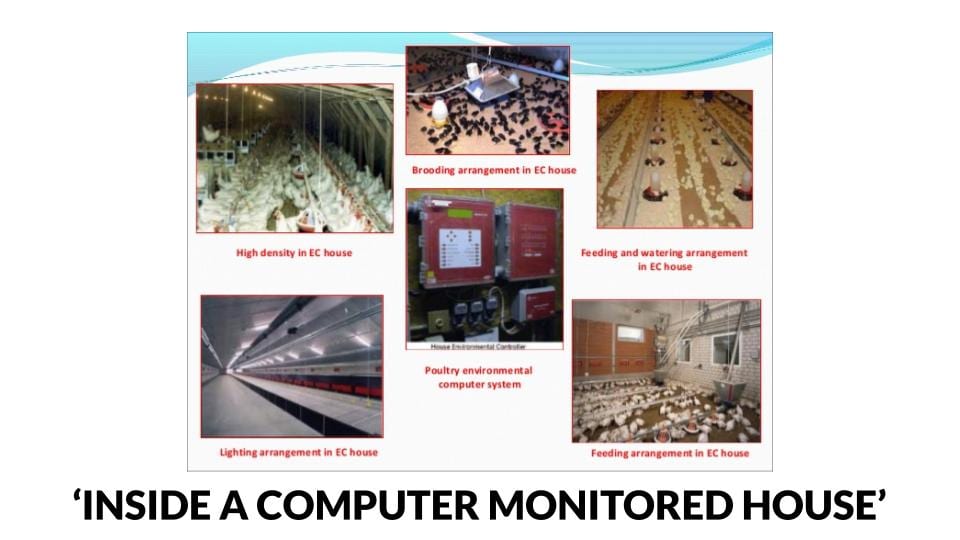

Perhaps a computerised automated house capable of housing 100,000 birds, with a control shed and all the motorised and programmable help possible.

If that is the case,

I have a serious investment proposal for you.

What would you say if a leading, international poultry farming professional told you that:

…a controlled environment shed could increase your feed conversion ratio by as much as 1 point?

In his own language,

“For larger companies, one FCR point is worth up to US$ 300,000 per year.”

Here is my analysis on how you can take Dhia Alchalabi’s advice and practically make it profitable…

My take:

Pictures of an automated, environmentally controlled poultry house are actually quite easy to find online.

However, getting quantity surveyor approved plans and accurate cost estimations is HARD.

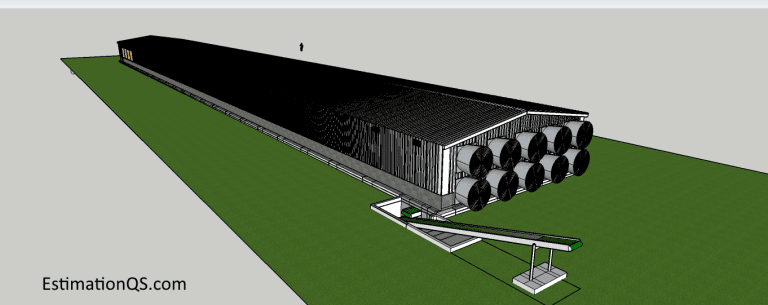

This is why I have included this next section a reference to www.estimationqs.com

Authored by Derrick Navara [a qualified Quantity Surveyor ‘QS’ with experience in construction-related projects],

The website hosts THE MOST detailed QS plans of some very complex construction projects, including…

This one (essential if you’re planning a computer-controlled poultry house):

As a first-timer…

…calculating a detailed construction budget for an ‘environmentally controlled’ poultry house is near impossible without professional input.

It’s a completely different type of project to building a wooden shed.

For a start, half of the components involved are completely foreign to most laymen.

But without accurate estimates, you simply can’t calculate the capital cost or raise funding.

So, I put this chart together based on the findings of Derrick Navara of Estimation QS.

Here it is:

(Source: https://estimationqs.com/cost-of-building-a-chicken-house-for-20000-layers/)

In response to a question from one of my readers,

I wrote this example budget calculation for a 1,000 bird pen.

As a premium subscriber, I’ll answer your questions via my Q&A board.

In this section, I share some leading examples of poultry house designs from around the world.

I’ve taken a selection of houses with different:

…and on different types of land, locations and in a variety of climates.

They should help you have an eye for what currently works out there.

Please don’t think that these are entirely representative of each country’s poultry farming enterprises –

Rather think of this as a photo scrapbook of example poultry farm buildings.

I tried to make them as varied as possible to appeal to many types of poultry business model.

(Also, for a decent beginner’s overview of poultry housing systems, complete with pros and cons take a look at this guide: https://agro4africa.com/types-poultry-housing-system/)

That complete’s this guide to poultry houses.

I included various designs, structures with their plans, construction budgets with materials costs, site layout, systems of housing, components, photos and even country examples…

Are you currently planning a poultry house construction project?

Do you have experience with poultry buildings and have something to add?

Either way, I’d be interested to hear from you.

Leave a comment below, now.

https://estimationqs.com/cost-of-building-a-chicken-house-for-20000-layers/

https://patents.google.com/patent/US3206121

University of Noth Texas Digital Library

www.alphafarms.co.uk (featured image)

Last updated on by Temi Cole 2 Comments

Today, I’m going to take you through the steps of how poultry farm loans work and…

…why you don’t need one!

I know.

The challenge of lifting your enterprise off the ground with little available capital might be overwhelming.

But before applying the blinkers…

Hear us out.

If you want to learn:

Read this guide.

“…a promissory transaction of money given (capital sum) by a lender [donor/giver] to a borrower [recipient],

…for the purpose of buying capital business assets to run a poultry farm,

…the borrower being bound by law to an agreement to restore the money in full to the lender within an agreed timescale and according to a prescribed schedule of instalments

…the agreement therefore having a clear commencement and a termination.

However:

…the money given comes at a real cost to the borrower,

…this cost is added on top of the repayment of the capital sum,

…the cost of borrowing is calculated as a percentage rate of return, known as ‘interest’

…the end result is the capital sum being used by the borrower for the duration of the agreement

…during which the borrower works to repay the capital sum back to the lender in full:

- on schedule, &

- with additional interest at the agree rate, paid on top.

Once both capital sum and interest monies are paid in full to the lender, the agreement is terminated and there are no further obligations or binding duties remaining for either party to fulfil.

Often as a measure of counteracting, “

A definition by The Big Book Project

The most common reasons for start-up farmers seeking after loan financing is to acquire:

Do you find yourself being in a situation similar to our ‘would-be’ poultry farming entrepreneur below?

Meet Arjun…

Arjun has designs on beginning a layer poultry farm in his home town, Bharuch in Gujarat, India.

He has a well paying I.T. contractor day job, but is set on making the transition from 9-5 into full time farming.

He owns a plot of land which measures just over 1 bigha, which until now has been left unused, but remains in tidy enough condition.

Arjun intends to cultivate a mixed agricultural production on his farmland including a variety of vegetable crops and of course his layer farm.

He wants to house 5,000 layer birds – taking approximately 10,000 sq. ft of his available land.

With this capacity of egg farm he hopes to produce enough to serve the needs of 30+ popular hospitality outlets in the city, Ahmedabad.

In order to start-up, he requires the following:

- poultry housing,

- feeders,

- drinkers,

- ventilation and heating equipment,

- a delivery vehicle,

- trays and

- 1st year operating expenses (to replace his wages)

Whilst he has savings, he prefers not to use them to start his venture – but opts for applying to borrow bank funds via a poultry farming loan.

Why not use the savings?

Without the loan…

Arjun is not confident that his personal savings will be sufficient to acquire all the capital assets which he has shortlisted to run the farm with…

As well as maintaining his household income.

Now to take a look at some poultry farm loans and learn how they work…

Arjun begins his search for a poultry farming loan by filing through advertised loan products online, seeking for the most favourable of terms and conditions to kick start his layer poultry farm.

Quite swiftly, Arjun found a selection of seemingly viable poultry farm loan opportunities in Gujarat.

He now reviews their application procedures & qualification criteria to see if they he is eligible to apply.

Whilst examining the small print of said bank loan opportunities (prior to any commitments), he also examines governmental grant subsidies which are available for ventures like his.

Before he puts his mind to arriving at a decision – he first plots out his projected poultry farming costs and profits using a project report.

He elects to download our 10,000 layer project report for an example financial plan to illustrate his plan in detail.

Having studied the details of the example project report, Arjun developed greater understanding of how a layer farm would be commercially calibrated…

But came away unsure about the real benefit vs. cost of starting his layer farm on borrowed funds rather than his own money.

Having searched online for poultry farming business consultants, Arjun found The Big Book Project team and submitted a query for help in understanding…

The true cost of taking out a poultry farm loan.

Here follows our professional advice on bank loans for poultry farms…

According to our definition of loan above, there are various components of a poultry farm loan, principally:

In an ideal scenario (post agreement – that is) every point on the list above would be accounted for and fulfilled.

e.g. the capital sum lent would be returned, by planned instalments, according to schedule with the cost of interest at the desired rate paid on top…

However, there is an important factor unaccounted for which ought to be addressed:

Risk.

The underlying reality involved with every loan arrangement is the ‘what-if’ scenario of:

“…borrower default.”

This simply means:

“What damage will be done if the borrower is unable to keep to the agreement and fulfil the terms?”

The real potential for this adverse occurrence of:

Failure to keep the terms of borrowing…

Gives credence to the lender laying on a condition of surety or security against the loan given.

Quite simply,

There is a clause added to the term and conditions of the loan which states:

If the borrower is unable to upkeep the terms agreed…

the borrower will forfeit, or lose, their possession of a worthy asset.

In the consumer finance market, where individuals borrow, for example:

Mortgages (long term loans) for the purpose of buying and living in a house:

They pledge the possession of the house they live in as surety to the lender, should they default on the repayment terms.

So, in real terms, if the borrower defaults on the agreement, the house they live in and call home…

(…which throughout the term of borrowing actually belonged to the lender – making the borrower a tenant renting from the lender for 40 years, for example…)

…will be seized by force, by the lender.

In agricultural business, the underlying assets are land and buildings.

As a start-up poultry farmer, let’s say, whether you have land in your possession or not…

If you seek the money of a bank, for example, to purchase infrastructural items like:

The bank will expect in return, as written in the terms of the loan arrangement, that in the event of a default…

You, the borrower, will simply be forced, backed and enforced by law, to hand over possession of the land and buildings used for the farm.

Repossession.

By etymological or root definition:

So, what you thought was your asset, is simply taken back by the one who legally possesses and has the power to legally enforce it’s return.

There is no recompense for your time to date, or your labour, nor consideration for your personal state following repossession…

Just a straight forward reclamation.

What’s the margin of failure?

It needn’t be much.

And it needn’t be reasonable.

In other words, the lender carries a guarantee that should the deal not go according to plan…

That they can liquidise the underlying/pledged assets, which by way of the legal written loan agreement, are (upon signing the paperwork) already transferred into pending ownership of the lender…

The lender from the time of signing is already guaranteed to gain, either way.

But…

On the contrary…

What guarantee does the borrower have…

Should the business they plan not afford them the ability to keep up with the loan terms of repayment?

Answer:

None at all.

Should the business not provide the scheduled profits according to plan…

The borrower carries full liability for upholding the terms of the loan agreement, regardless.

As with life firstly and therefore business thereafter, in general:

Things don’t always go to plan.

And there are a multitude of things which can go against the theoretical assumptions of your poultry business plan:

…what if any of these entirely plausible happenings occur and work against your planned profits…

Causing you default on your loan terms…

Where is your guarantee or surety should these things happen?

Risk is not unilateral…

It is works both ways.

Why bind yourself to an inequitable agreement which puts you at great disadvantage from the start of your venture?…

(And unnecessarily so.)

Why take a bank loan to start your poultry farm?

Is it an option worth taking?

Or should it even be an option?

Take the details declared on the application form of the IDBI Bank as an example:

In order to have the credited funds released to you by the bank, the bank will require the information above.

But why so much?

What relevance does all that information have in the scheme of arranging a bank loan?

Point no. 1 ‘other credit or borrowing arrangements’ –

Point no.2 ‘formal or informal borrowing arrangement’ –

Point no.3 ‘land holdings held by the borrower’ –

Point no.4 ‘business income statements‘ –

Point no.5 ‘net worth’ –

Point no. 6 ‘guarantor‘ –

Ask yourself the question…

Also, if the lending party requires such an invasive screening of your personal & financial condition…

Plus, requiring the personal collateral of an able substitute and acting guarantor, should you as the borrower default…

Are you as comprehensive in your poultry farming business planning – to support a confident projection of future profits and earnings?

If the bank is this diligent in evaluating your financial position prior to lending…

Have you done at least as much due diligence in your own project planning, in protecting your own future entrepreneurial benefit?

If the answer is, no:

Then you should consider revising your poultry business plans to have a far more evidenced foundation.

Summarising from various lender’s (inc. State Bank of Pakistan) published eligibility requirements for poultry farm loans…

Poultry Farm Loan Eligibility

The following is a brief list of eligibility criteria:

- sufficient knowledge, expertise and training in poultry farming

- …this ensures that handling of the poultry farm is in competent hands – being able to fulfil the operational duties to an optimal level

- repaying capacity

- …the likelihood that the borrower is able to pay the lender back with interest over the agreed loan duration, not only from the proposed poultry farm profits, but also from existing income

- managerial skills

- …how feasible the financial projections and estimations on paper really are in the hands of the borrower

- margin money (borrower’s contribution)

- …the borrower contributes as much as 25% of the total loan amount out of their own pocket towards the loan amount applied for

Ask yourself…

If you already have the:

…this begs the question…

Why would you then be looking to legally bind yourself to a loan arrangement and run the real risk of losing your land?

Or worse, why would you risk your home and future earnings?

Why not start smaller and within your means? And without the risk of losing assets if things don’t go exactly to plan.

A model report for a poultry farm loan tells a bank or lender:

Your precise approach and adopted business modelling for achieving the expected profits.

The key features of a model report for a poultry farm loan are as follows:

- Type, capacity and rearing model

- …exactly what type of poultry farm you have in mind & how many birds you expect to be rearing at any given time, plus the system of organising them for optimal results

- Poultry buildings

- …how you expect to arrange the birds into housing according to your prescribed rearing model

- Farm equipment

- …the necessary feeder, drinker and other relevant equipment needed for running your poultry farm

- Batches & rearing intervals

- …your system for replenishing your poultry flock with optimally productive birds to keep your business output consistent

- Operational costs

- …your estimation of direct costs of sale and overheads for your poultry farm business

- Start-up capital requirements

- …how much total start-up funds would be required to acquire the necessary items to begin your proposed farm operation at the planned size and scope

- Production

- …how much output you expect your poultry farm to produce at the given intervals of production

- Income statement

- …how much profit (surplus income) your proposed poultry farm is expected to make annual over the loan duration

- NPV (net present value)

- …how much the money loaned today would be worth at a future date as discounted against the proposed interest gained of an equivalent investment opportunity

- BCR (benefit cost ratio)

- …how much the respective costs of the proposed poultry farm are covered or can be absorbed by the corresponding benefits or profits of the business

The conclusion of the report being BCR (benefit cost ratio) is the indicator by which any prospective lender will evaluate the attractiveness of your proposed poultry farm business…

‘Attractiveness’, in other words meaning…

The ability of your proposed business (on paper, at least) to provide the profits by which to suffice:

…and not necessarily in that order.

Where a business on paper offers the potential to achieve all of these benefits and more – banks and commercial lenders will be very willing to lend (all other eligibility factors being in place, of course).

Where the proposed benefits are insufficient to cover such costs, banks will reject the proposal.

Having produced such a report for the purpose of obtaining a secured poultry farm loan…

Why would you hand over the potential future benefits of your poultry farm to paying back a lender (?)…

Who during the course of running the farm will simply seize the land, or buildings should you be unable to keep to the terms of your loan agreement (thus derailing your earning potential to dig yourself out should things improve)?

Think carefully.

Governments worldwide offer subsidy schemes and grants to ‘would-be’ poultry farmers who are interested to apply for commercial funding.

Everybody knows a government handles public funding, as opposed to private funding.

And that governments sometimes provide both loans and grants to producers of various kinds via finance schemes, making available capital sums for investment to individuals and businesses who meet the criteria for receiving.

Loans and grants/subsidies principally differ on the premise of repayment.

Loans are to be repaid.

Whereas grants and subsidies are not.

The definition of subsidy:

Where the cost of commodities are relatively high and therefore prohibitive for many to access…

Governments will often allocate protected (ring-fenced) budgets from public funding, for the purpose of reducing the cost of the said commodity on the open market.

However, the mechanism for how this works in practice may not necessarily be as most lay-consumers would expect.

Take the example of the Nabard – Poultry Venture Capital Fund Scheme.

The method of delivery for scheme is known as a back-ended subsidy.

“A back-end subsidy involves direct payment of a subsidy at a later date to the borrower, who pays the market rate up front.“

This simply means that in order to encourage prospective borrowers to obtain poultry farm loans from commercial providers like, State Bank of India (SBI)…

The Indian government (in this case) promises to reduce the cost of the commercially available loan repayments by 25% for the borrower’s sake, by way of granting the borrower a lump sum capital payment…

…equivalent to 25% of the total loan value…

But this back ended payment is only paid to the borrower after the bank loan has been repaid in full by the borrower according to the repayment schedule.

Only after the commercial loan has been repaid, will the government then release the subsidy funding to the borrower directly.

This in effect indeed does the job of decreasing the cost of the loan taken by the borrower (assistance), which were taken upfront…

Albeit, by way of a back-ended capital subsidy…

i.e. at the end.

Example poultry farm loan scenario…

Indiafilings.com the online tax filing service for India gives great insight as to what the stipulations of:

- margin money (entrepreneurs contribution)

- back ended capital subsidy

- bank loan

…would look like when explained side-by-side…

The following assistance is provided under the Poultry Venture Capital Fund Scheme:

- Entrepreneurs contribution (margin) – for loans upto Rs.1 lakh, banks may not insist on margin as per RBI guidelines. For loans above Rs.1 lakh: 10% (minimum).

- Example:

- If a poultry business is to be setup with a total investment of Rs.10 lakhs, then the Entrepreneurs contribution or investment must be at least Rs. 1 lakh.

- Back ended capital subsidy – 25% of outlay (33.33 % for SC/ST farmers and NE states including Sikkim)

- Explanation:

- In a back ended capital subsidy scheme, the Entrepreneur would have to avail and bank loan and pay the installments due.

- The final loan installments equal to 25% of the total investment amount would be adjusted as back ended capital subsidy.

- Effective bank loan (excluding eligible subsidy as above) – balance portion, minimum 40% of outlay

- Explanation:

- Bank loan must be obtained for a minimum of 40% of the total project cost to avail subsidy.

- Therefore, if the total project is Rs.10 lakhs, then the bank loan component must be at least Rs.4 lakhs.

A very helpful and illustrative way of showing how the expectations of a borrower in a poultry farming bank loan agreement interact with government subsidised payments.

Good job, Indiafilings.com!

Now, back to evaluating the benefit of a government subsidised poultry farm loan:

Whilst a subsidised loan to start your layer or broiler farm may indeed seem a preferable method of getting your enterprise off the ground…

Again, why not ask yourself the question…

If you are able to qualify for receiving such financial assistance from both a commercial bank as well as the government…

And will agree to wait between 5-7 years of repaying your poultry farm loan in full…

Whilst bearing the risk of losing your underlying capital assets of land and buildings…

And only at the length, after the course of 5-7 years of repayment in full, receive the benefit of the subsidy…

Why don’t you…

Start your poultry farm at a more modest level within your means…

Growing the business organically from your own personal finances & hard work…

Keeping all the profitable benefits produced by the enterprise…

And not running the risk of losing capital assets should things not go according to plan?

I know…

The sober talk of living within one’s means might be a far cry away from what you were thinking before reading this guide…

But, you must admit…

It is worth asking the question:-

Growing a 1,000 bird farm steadily and organically for 5-7 years to 35,000 on your own steam without any binding agreements or risk of total calamity…

Or,

Getting the keys to a 20,000 bird poultry farm leveraged to the eyeballs and with only the smallest margin for error available – and the pending seizure of asset repossession hanging over your head whilst you slog away everyday at a venture – the promised profits of which are already levied against by lenders…

What’s really in it for you?

If you want our advice…

Your thoughts…

Feel free to comment below.

Last updated on by Temi Cole 7 Comments

There’s a now pro way of looking at your cost of rearing layers or broilers that could SERIOUSLY help you smash those ROI targets.

I call it:

(“Econo-Poultry Technique.”)

I recently refined this strategy and packaged it in the new version of our in-house poultry consultancy software: Poultry Project Reporter 2.0

And in today’s discussion on the economics of raising chicken either for meat or eggs, I’ll share with you exactly how I did it (and step-by-step).

[Can’t read it all now? Download the PDF, by clicking on the orange button above.]

Opportunity cost is, without doubt, the BIGGEST hidden cost in starting a poultry farming business.

When calculating the potential return on your poultry farm investment,

You’ve probably not accounted for opportunity cost.

(If you haven’t, you’re not alone.

In fact, when I posted this premium newsletter on ‘opportunity cost’ to my email subscribers recently, I received a HUGE response. )

99.9% of small & medium-sized business owners totally ignore this iceberg of ship sinker.

Before my brief experience of working for a business broker, I didn’t really have opportunity cost on my radar either.

But things changed when I got schooled on this critical ROI planning technicality.

If you’re new to the phrase,

Opportunity cost is the very real and tangible (yet indirect) cost of having your money, time and resources tied up in an investment…

…when you could have ploughed that potential elsewhere.

It’s not to breed doublemindedness and indecision.

Far from it.

It’s actually a way of shoring up your confidence in the decision.

Here’s how…

In assessing the opportunity cost of starting your poultry farm you perform what professional project managers call:

Alternatives analysis.

In this short paper exercise, you literally compare in a head-to-head fashion the future prospects of alternative investments you might choose instead…

…against the projected financial benefits of running your broiler or layer poultry farm.

Beginning…

Let’s say,

That you calculate that your 1,000 layer flock would bring you in $11,000 EBITDA (net profit) per annum in egg sales alone.

Over 6 years (with a 1st-year climb to reach peak performance) you could expect your layer poultry farm to net you $54,000.

But the business, according to your figures, might cost you $20,000 start-up investment.

The net benefit over 6 years would then be $34,000 for running the poultry project.

Middle…

Now, at the same time as planning your poultry farming business,

You get an offer from a friend to buy an online business.

It will cost you $12,000 and on the books, it currently generates $333.00 per month (it is being sold to you for a multiplier of 36 times the monthly revenue.)

The web business has a lean cost model and $300 of the total revenue figure is net (take-home) profit.

Over 6 years, this venture would NET you ($300*72 months):

$21,600.

The other fact to account for is your time involvement.

The web business runs on 2 hours per week commitment.

Your poultry business would require perhaps 25hrs+.

The cost in wages or time expense over 6 years would be around $50,000.

The opportunity cost of you starting the poultry farm would be ($21,600 + $50,000) – $34,000 = – $37,600

In other words, by this crude estimation, you would be $37,60o worse off for choosing the layer business.

But like I said this is a rather crude view,

What about:

If from these points alone, you estimate an additional benefit of, say $45,000 over the next 6 years.

Your opportunity cost works out to be:

($21,600 + $50,000) – ($34,000 + $45,000) = +$7,400

i.e. You’ll be $7,400 better off in poultry.

(Not to mention – the lifestyle benefits of being in agribusiness.)

The poultry farming business is constrained or defined by some pretty fixed parameters.

These factors have their own relationship to the costs involved in raising the birds.

Here are some examples:

Broiler meat chicken typically in commercial rearing take somewhere between 6-7 weeks to reach marketable weight.

The equivalent optimal time frame for rearing layer chicken is about 72 weeks in commercial farms.

The point at which the cycle hits the endpoint is called Break Even.

In other words,

If you keep commercial layer birds any longer than the point of break-even (~72 weeks generally speaking) then you begin losing money to keep them.

(i.e. the cost of rearing them exceeds the revenue gained from egg sales.)

The same applies to commercial broiler chicken.

Keeping them beyond 6-7 weeks becomes loss-making. The direct cost to keep them starts to overshadow the sales revenue from selling the birds.

These three options for starting poultry production are like choosing lanes before a 200m race.

Each has its own cost advantages and disadvantages.

(They all amount to the same distance – but your preference is simply based on how you see things.)

Here’s how they line up:

With both broiler and layer farming, you can choose to hatch your own chicks to raise.

This is starting on the inside lane.

You seem further away from the end than the other lanes at the start, but it’s an optical illusion.

Yes, you run the costs of buying the fertilized eggs and incubating them until the successful ones hatch.

But you save on the cost of paying for a day old chick or even a pullet (if you run a layer farm).

As you can imagine sellers of day-old chicks and pullets charge much more for these than fertilised eggs.

They recoup their costs of rearing the birds by charging a price that covers their expenses,

PLUS gives them a healthy margin of profit.

So, going back to the sprint race analogy,

Buying day-old chicks for your broiler or layer farm is like taking up the middle lane.

And if you produce eggs, buying pullets is the outside lane.

Basically, each course runs the same length.

But because of the offset difference from the lane orientation,

The runners start at different positions on the track which at the beginning might seem like some are at advantage whilst others are at disadvantage.

But it all adds up to the same at the end.

The key is not caring where you start, but mentally blocking out all distractions and running YOUR best race.

When calculating the costs of raising chicken,

You’ve should also account for the constant flux of input volume (amount) and velocity (speed) throughout their growth stages.

Plus, the differing nutritional demand of birds at different ages.

The combination of factors leads to fluctuating cost burden.

But this is a slightly simplistic view of things.

Because with a muli-flock model – these changes are smoothed out by the layering of needs.

One flock’s needs insulating against the farm’s exposure the needs of another…in a staggered fashion.

This brings us on to…

These are your classic direct costs or the cost of goods sold (COGS).

Investopedia classifies these as being:

“Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company.

This amount includes the cost of the materials and labour directly used to create the good.”

In the sense of your poultry farm,

These are relatively easy to figure out…

To produce a table bird or a table egg, your need:

(Depending on your model of production, you could also include within this cost of vet care/meds etc.)

Now, let’s examine these costs…

As I said earlier,

The cost of acquiring each bird is like choosing your lane to run in – if you think of poultry farming like a race.

Let’s look at some real example costs,

And how this choice of start point will affect your farm’s cost model.

These are some example prices from hatcheries in the United States:

As percentages of the point of lay cost, here’s how they line up:

And if we line up hatching egg cost vs. day old chick cost, we get:

Whilst these numbers by themselves don’t tell us much,

If we look at them in the light of production and yield we learn a little more.

Egg-laying

Peak egg production (according to the HyLine Commercial Brown management guide) occurs at about week 22-23.

At this point, commercial strain layer bird, like the HyLine Commercial Brown should achieve a hen-day egg production of ~90%.

This is the part every layer farmer looks toward,

Because the birds begin earning back.

Before then, your farm bears the brunt of having to fund the rearing without return.

The longer the delay to peak laying…

…the longer your farm’s delay to earning back (recouping) the cost of pre-lay rearing.

Broiler meat birds

Conventional broiler birds are reared for 6-7 weeks and then marketed.

There isn’t a pullet equivalent for broiler farming.

At maturity, the bird itself is harvested, and so all gains must have been made beforehand.

This leaves only hatching eggs or day-old chick as viable start points for broiler farming.

Again, hatching eggs costing about a third of the price of a day-old chick, typically.

(Sellers of birds, rather than eggs, passing on the cost of rearing to their customers.)

Broilers

According to the Broiler Management Guide written by Livestock Feed Ltd.,

The average conventional broiler breed bird will consume approximately 5.3kg in 6-7 weeks of rearing.

Estimating the cost of feed across the entire rearing period isn’t directly linear (straight forward).

At each stage of growth:

…optimal growth yield is achieved by feeding birds with their appropriately formulated age-related feed ration.

Each type of feed is priced slightly differently on the basis of a different balance of ingredients.

But taking an average, in Nigeria broiler feed could fetch for ₦240.00 per kg.

So the equivalent cost of feeding a broiler bird from day one to week 6-7 is roughly speaking:

₦1272.00

Layers

Again the HyLine performance sell sheet indicates that their layer strain, Commercial Brown hens, consume:

~49kg of feed in 72 weeks.

The equivalent feed cost to rear layers will be ₦17,280.00

By comparison, the cost of feeding layer hens through a full production cycle is:

…13.5 times more than rearing a broiler bird (through its equivalent production cycle of 6-7 weeks).

In context

But we can never just look at cost in isolation.

The cost has always got to be viewed in the light of ROI to assist in strategic decision making.

Just think,

An average layer is likely to lay some 330 eggs in the space of 72 weeks, from a one-day-old starting point.

At an average price of 12c ($0.12) per egg,

Each layer hen is scheduled to generate some $39.60 over the course of its commercial lifetime.

By comparison, broiler chicken might be sold for $4.7 ($1.62 x 2.9kg per bird).

Now, put this in the context of your previously cost of feeding broiler or layer birds and you can quickly arrive at a profitable conclusion.

Aside from the principal direct costs (as I call them), being:

There are other costs associated with production in broiler and layer farms.

Namely:

To factor these in, we apply two different calculations.

Labour is calculated at:

The product of this equation is a simple wage bill.

For vet and med fees, I apply a flat fee per bird. The total bill absorbed equally by each member of the flock.

This method is called absorption costing.

(A neat way of accountants spreading overhead costs across products and services sold.)

When you use this method you end up with a useful yardstick for estimating vet/meds cost per bird.

You simply calculate a flat fee, which can then be multiplied by the heads of the flock.

But what about one-off costs?

Starting a poultry farm typically involves some one-off costs too.

These are usually asset purchases.

Items like:

…are bought once and will be used repeatedly until the end of their useful life.

This brings us on to…

Most physical assets need replacing or deep restoration after some time.

This cost is a very real deduction from your business budget.

And in most cases unavoidable and entirely expected.

Plan ahead.

In common business accounting practice,

The funds separated for replacing a physical asset when it becomes spent is called depreciation.

Proactively, your poultry farming business should include depreciation within your income statement as an expense.

You’ll want to plan for this expense, otherwise, if you overlook it, you’ll be caught off-guard when you least expect it.

Without ringfencing money for this,

Say, if your layer farm had to replace your delivery van after 6 years of continual use,

Coming up with say, R200,000 (South African Rand) on the spot could be difficult.

(Depreciation to the rescue.)

When starting a poultry farm,

You’re going to need to ‘prime the pump’ before you generate sustainable cash flow.

So, in the first instance – at least for the first year of trade – you need to fund your own operating expenses.

Buying:

etc. will have to be financed with cash either from your own supply or from external investment.

This is known collectively as working capital.

In other words,

The money you need to run the operations until it becomes sustainable.

For example,

If you calculated that running a 30,000 layer egg production farm in the Philippines would cost you ₱14,063,140.00 in bird feed for the 1st year,

+ ₱600,000.00 in chick costs for your 1st 30,000 birds in 3 separate batches.

The working capital for year 1 would therefore be these two figures (₱14,063,140.00 + ₱600,000.00),

PLUS other direct costs – like labour etc.

Then lastly, you’d add the overheads (indirect costs) on top…

These are a bit like what they sound like.

Costs that will hang over your head whether you produce or not.

Costs like land rent, for example.

They are not directly related to production,

But, granted, without rent paid and the farm occupation legitimate you simply cannot run a successful poultry farm.

So overheads can be really important costs.

With calculating overheads, there could be different approaches for handling each item,

But the bottom line is a grand total of indirect costs of the poultry farm.

Now, onto funding…

Poultry farming ventures are usually either self-funded or financed on borrowings.

Actually, poultry is one of the few livestock-related agri ventures that can be started VERY small and scale quickly.

Zero-debt is great because it’s lean.

(Less expense.)

Loan repayments are an unavoidable business expense, where you have debt.

(And so, debt horrendously undercuts your profits.)

For example,

I recently came across a PDF project report of a 20,000 layer farm published by the West Bengal Poultry Federation.

In the loan statement, they published a loan requirement of 127 Lacs.

This got me thinking…

…How much would the repayment on a loan like that be?

I fired up Poultry Project Reporter software – and only a few minutes later…

A loan of 127 Lacs to finance a 20,000 layer farm start-up at 6% interest would mean Rs.210,475.68 monthly repayment over 72 months (6 years).

This being taken directly out of your bottom line, whether things are going to plan or not is a steep start.

(Ouch.)

Just like finance, a common thought is that you need middlemen to make a market tick.

Whilst they do work to aggregate transactional opportunity,

In other words – put people together who might trade (buy and sell),

Their involvement is not essential.

Much like any part of the industry which performs a service, but is non-essential:

Middlemen = COST.

Sales commission is the reward of their labour.

A slice of the action.

This percentage deduction is a business cost and should be accounted for in the overall cost of getting the product to the consumer.

Also, if you import the chicks, for example, a very real cost is foreign currency exchange (or FX).

In most cases, your bank will deal with the exchange.

But having worked in a corporate FX brokerage some years ago, I can confidently tell you that bank FX charges include some serious amounts of spread (profit).

To the tune of several per cent in most cases.

Brokerages can shave cost in this area, but you always need to walk into transactions with your eyes wide open.

Losing 5%, for example, on every trade to buy birds, feed etc. takes a significant amount of your take-home pay straight out of your pocket.

Another secret cost threatening your poultry farming profits is inflation.

(The continually increasing cost of living – worldwide.)

This is one of the BIG costs to discount your poultry farm ROI projections by.

If you don’t tune down your expected earnings by the effects of inflation,

Then you end up with an INFLATED expectation on your future broiler or layer earnings.

This only leads to disappointment.

So always, always remember to discount poultry cash flow projections for:

a) opportunity cost, and;

b) the cost of inflation

In fact,

That’s EXACTLY why I built in a discounted cash flow feature into the Poultry Project Reporter software, that automatically adjusts your future expected cash flows by a set percentage.

For example,

To add the cost of inflation if you were planning a egg production farm in Uganda (based on 2020 figures),

You’d simply type into the PDF fillable web form ‘4.2’ (to represent the official Ugandan national inflation figure for 2020, which was up 45.57 % from 2019)

…the software will do ALL the rest and give you a PDF report of your Uganda poultry farm cash flow for 6 years,

Adjusted to inflation, of course.

No need for messy manual calculations.

All done for you.

Now,

That’s enough of the theory.

In this section,

I want to throw you some quick cost percentages that you might use to guide your own poultry farm cost calculations.

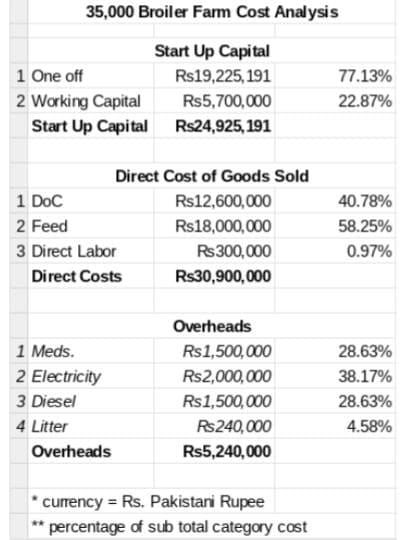

Here are the percentages (based on environmentally-controlled shed rearing conditions):

(Analysis based on sample data published by The National Bank of Pakistan)

Roughly speaking, a project of this size and nature would have SIMILAR benchmark costs.

But I must say it again, this is ROUGHLY speaking.

There’s no way that you could rely on these exact numbers for your cost plan.

If you think about it, there are just too many variables involved:

…this list goes on.

So, the purpose of these percentages is to give you a ‘real-life’ feel of what a poultry project cost line up looks like.

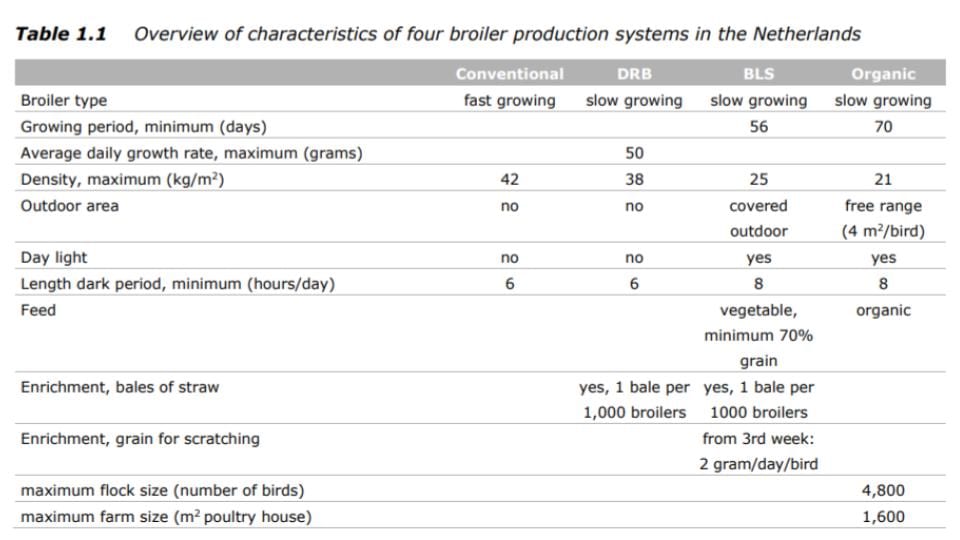

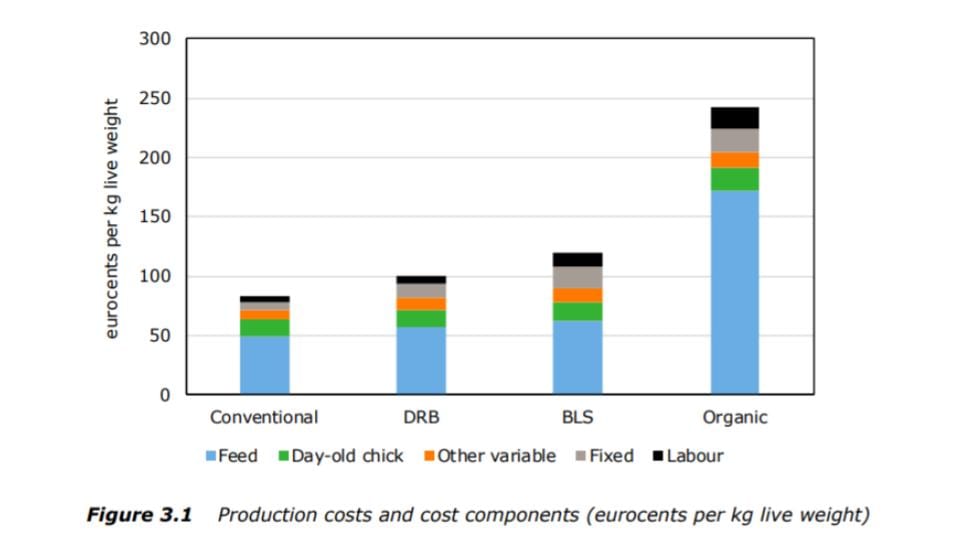

I recently found this study on the “Economics of broiler production systems in the Netherlands” by Wageningen University & Research.

It’s a great insight into how your choice of broiler farming system directly influences your costs.

The four broiler systems compared within the study are:

Whilst you are probably familiar with the potential consumer health benefits associated with organic & free-range poultry farming over congenial rearing,

You may not have much insight into how the operational costs differ.

And WHY they differ?

Here’s a breakdown:

Characteristics of the broiler systems

The criteria above will help you better understand how each of the poultry systems works.

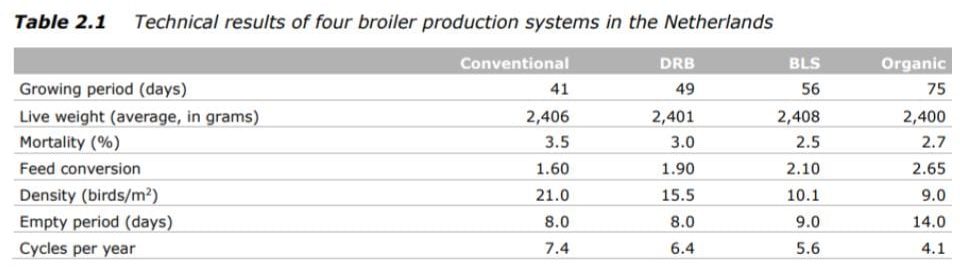

Technological factors and parameters

Here you see the operational differences between the 4 broiler systems.

The further you move away from conventional broiler farming towards organic, we see:

Generally, decreasing operational efficiency for the sake of passing on product quality benefits.

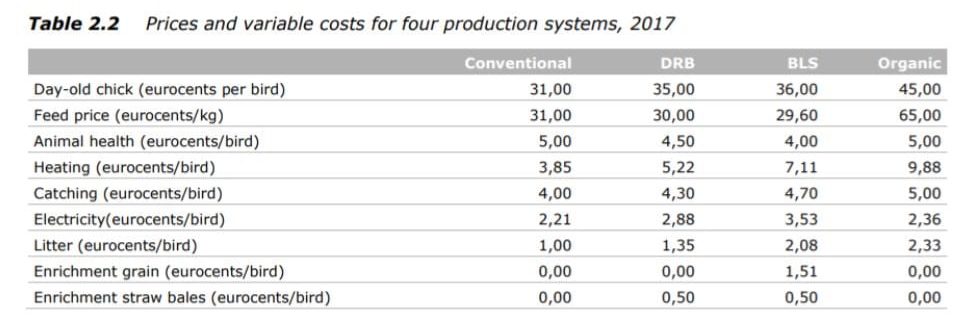

Variable costs comparison of broiler systems

As a broad brushstroke statement,

We could summarise by saying – better product quality means higher direct costs.

Production cost comparison of broiler systems

Better broiler product quality and consumer nutritional benefits (with free-range and organic methods) come at the cost of the producer.

They generally have:

Here’s why…

Increased labour

“…higher labour input due to a higher surface area per bird and extra labour for providing grain and straw bales.”

Organic and free-range (DRB, BLS & Organic) workers have to cover more area and have much more hands-on rearing duty than with environmentally controlled conventional farming methods.

More fixed cost (overheads)

“…the density is lower the costs per m2 poultry house have to be divided by a lower number of produced broilers per year. ”

“For free-range systems the fixed costs include the costs of land and fencing. The fixed costs increase as the growing period of the broilers is longer.”

Higher welfare, better product quality systems (DRB, BLS & Organic) cost more in general overheads, labour and capital asset expense than conventional systems.

More expensive chicks

“Day-old chicks of slow-growing breeds are more expensive than conventional breeds”

“For organic, the costs are extra high because of an extra vaccination in the hatchery.”

A price premium attached to slow-grow day-old chicks and additional vaccinations at the hatchery adds yet more cost to the higher welfare models (DRB, BLS & Organic).

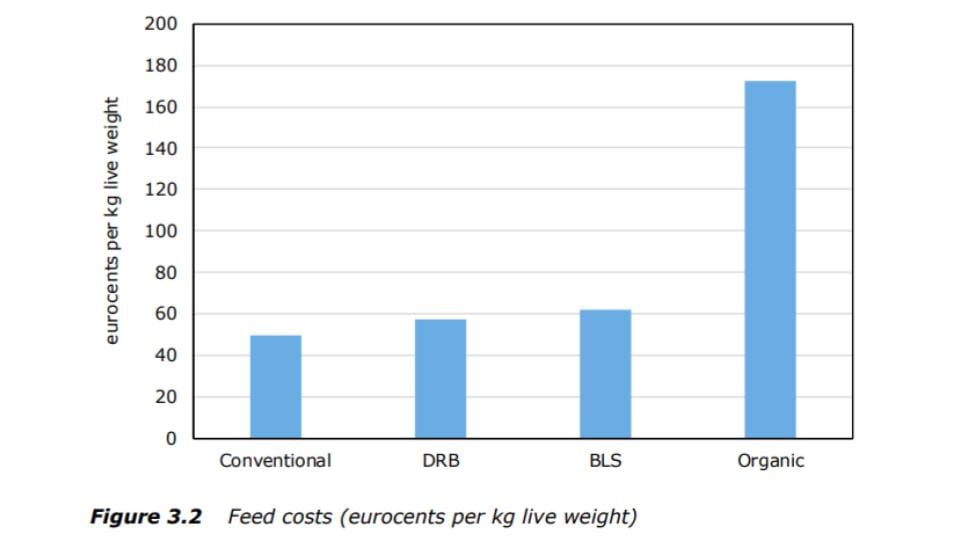

Higher feed cost

We see a gradual feed cost increase from conventional to free-range (DRB & BLS) as the rearing cycle increases from 41 days to 56 days.

The longer rearing cycle carrying a higher feed consumption.

The largest increase, however, is seen when we switch to organic practices where we witness an almost 300% leap in feed cost.

This is due to a combination of higher feed costs for organic ingredients and also a rearing cycle of 75 growing days.

And now, a couple of pointers to help you produce some really ROBUST cost projections for your poultry farming project.

Gathering together supplier proposals and price quotes can be quite a chore.

It’s repetitive, detailed and time-consuming.

This is where a useful template (or proforma) would be worth its weight in gold.

Especially, one that was easily downloaded in PDF format.

Well, I’ve got one better than that for you…

How about a purpose-made PDF fillable web form that:

…professional standard RFQ/RFP (request for quote/proposal) documents?

Click here to use it now (premium subscribers only).

When putting together feasibility studies or project reports, you’ll want to put your mind at rest with some what-if scenarios.

The kind that help you report on outcomes when critical conditions change.

(…especially changes in costs, like feed or chicks.)

For such planning exercises, I recommend using sensitivity analysis:

Simply, you run side-by-side profit and ROI calculations, but with each attempt, you change a cost value.

For example,

I can use Poultry Project Reporter software to test my farm’s profit sensitivity to…

…say, a feed price increase of 25%, from ₱.26.00 to ₱32.50…

All I have to do is type in my new feed cost,

And now I see the gross profit contribution (over 72 weeks of rearing) of each egg-laying hen change from:

₱591.86

…to…

₱273.75

My next step will be to see how my operational profit lines up once all overheads are absorbed into that figure.

Will I still be in profit?

Perhaps that’s for another article.

Are you currently calculating the cost of rearing poultry?

Have you experience of rearing broilers or layers?

Do you think I missed something?

Either way, I’d be interested to hear from you.

Leave a comment below.