Income Statement & Poultry Project Budget – PDF Output

This is an example poultry farming project report ‘income statement & budget’ summary…

Want to know the profit position of your poultry farming project?

This income statement is a summary of your combined income streams lined-up against your collective running costs.

The fruit of an income statement is the figure of gross profit or surplus at the end of each year.

It simply expresses the gross amount of profit or surplus (positive value) – made by your poultry farm…

Or otherwise, losses incurred (negative value).

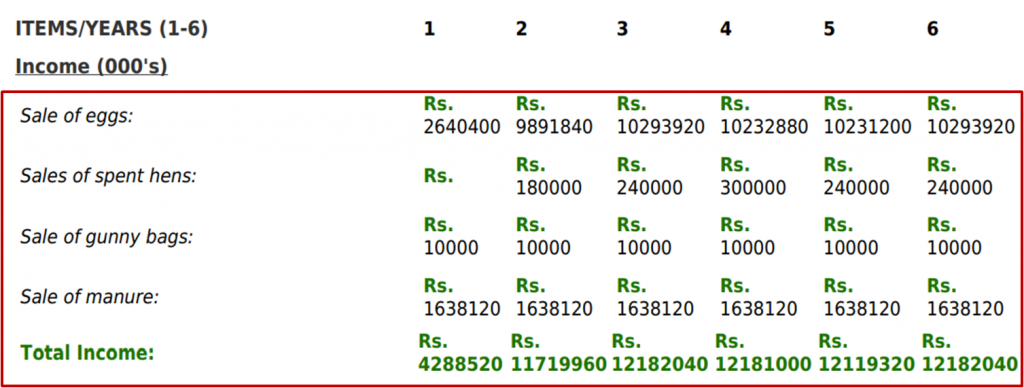

F1. Income

This is an example poultry farming project report ‘projected income’ summary…

Above we have the income half of the example income statement & budget.

As you can see, each line of income is itemised by title of category.

The final row (whose header is in bold green text) is the total figure of all income streams added together.

Let's examine this part of the statement further...

Having just taken a look at the production figures of this poultry farming project in the previous chapter, many of the row headings we will recognise instantly...

As well as their corresponding numbers.

The only surprise here will be:

Gunny bags

What's a gunny bag?

Gunny bags are used hessian sacks which your bird feed typically arrives in.

These gunny bags hold a stable resale value for re-use.

This is an additional income stream worth noting.

*Note: If you are looking quizzically at the empty space in the spent hens year one column, remember...

Spent hens are by definition 72 weeks old by this model. It is therefore impossible by this model to acquire spent hens in year 1 (being only 52 weeks long!)

Further reading:

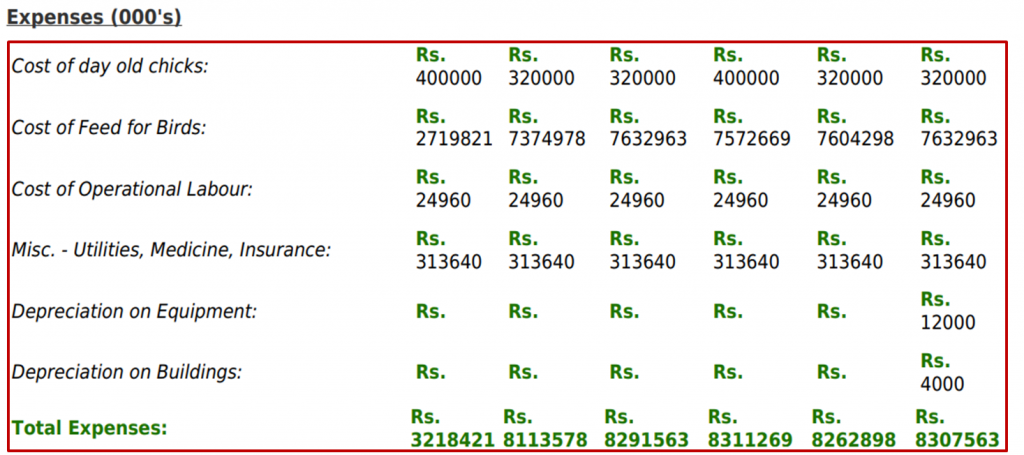

F2. Expenses

This is an example poultry farming project report ‘projected expenses’ summary…

The table above is a rundown of the common expenses of this poultry farming project, as declared in the previous chapters.

The only addition here is depreciation.

Depreciation is defined here as being…

“The monetary value of an asset decreases over time due to use, wear and tear or obsolescence. This decrease is measured as depreciation.”

Why is depreciation added to expenses on your income statement?

Financial prudence would have it that in planning your proposed poultry project you account for the replacement of capital items for wear & tear in particular.

AccountingCoach.com put it like this…

“The depreciation reported on the income statement is the amount of depreciation expense that is appropriate for the period of time indicated in the heading of the income statement.”

In this example...

The amounts of depreciation added to the expenses for replacement of both capital equipment and buildings are nominal figures:

12,0004,000

...respectively.

Why nothing more accurate than nominal/arbitrary figures?

There are just so many ways to calculate depreciation and account for it in formal paperwork that we decided against prescribing.

Each industry, country and tax jurisdiction will dictate norms which we just couldn't account for within the scope of this article.

Get advice.

Further reading:

- Calculating Depreciation On Fixed Assets – WikiHow

- Potential Tax Strategies for Depreciating Broiler Chicken Houses – Louisiana State University Agricultural Centre

F3. Gross Profit (Surplus)

This is an example poultry farming project report ‘gross profit’ summary…

![]()

The table above shows the gross profit of your poultry farming project, across the 6 year period provided.

From this figure…repayment of debt obligations, taxation, reinvestment and personal dividends/earnings shall be subtracted.