Sample Layer Farm Valuation (NPV, IRR, BCA, DCF) – PDF Output

This is an example poultry farming project report ‘NPV, IRR, BCA, DCF’ summary…

What is the proposed benefit of your project to a prospective investor, minus the discount of a competing opportunity’s interest rate & future cash flows?

What is the ratio of the profitability of your project vs. the capital start-up cost?

Meet net present value and benefit cost ratio.

Each can be defined as follows:

NPV

“In finance, the net present value (NPV) or net present worth (NPW)[1] is the summation of the present (now) value of a series of present and future cash flows. Because NPV accounts for the time value of money NPV provides a method for evaluating and comparing products with cash flows spread over many years, as in loans, investments, payouts from insurance contracts plus many other applications.” – Wikipedia

Why are the values discounted?

“The cash flows in net present value analysis are discounted for two main reasons, (1) to adjust for the risk of an investment opportunity, and (2) to account for the time value of money (TVM).” – Corporatefinanceinstitute.com

BCR

“…desirability of public projects as far as the expected benefits on the capital investment are concerned. As the name indicates, this method involves the calculation of ratio of benefits to the costs involved in a project. ” – NPTEL

“…a project is considered to be desirable, when the net benefit (total benefit less disbenefits) associated with it exceeds its cost.” – NPTEL

Investors use NPV and BCR as indicative markers to inform them of whether of not the proposed project is technically beneficial or attractive.

A yardstick or general measure or rule of thumb.

NPV Formula:

Rt = the net cash flow i.e. cash inflow – cash outflow, at time t.

t = the time of the cash flow

– the discount rate, i.e. the return that could be earned per unit of time on an investment with similar risk

BCR Formula:

BCR = Discounted value of incremental benefits ÷ Discounted value of incremental costs

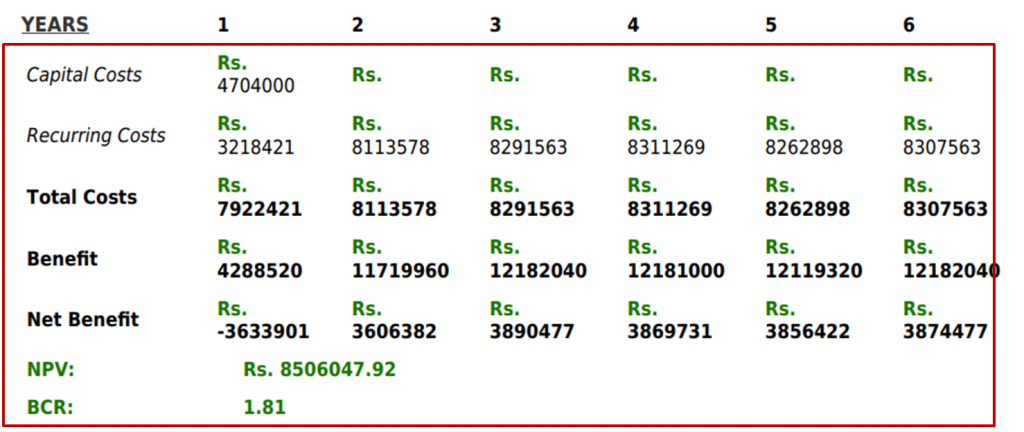

G1. NPV & BCR

This is an example poultry farming project report ‘Net Present Value & Benefit Cost Ratio’ summary…

Firstly calculating discounted cash flows…

A comparative interest rate of 12% is used for the purpose of this analysis.

The cash flows in the table above are therefore discounted across the 6 year period by the interest rate of 12%.

When we discount the cash flows in this way we are saying, this is the cash remaining after taking away the projected benefit of a comparative gain of an alternative investment benefit.

Let’s say this practically.

Discounted cash flow is the benefit remaining from running the proposed poultry farm across 6 years above and beyond the gains projected from let’s say, a 12% savings account.

Let's run our 6-year example discounted cash flow:

Year 1...

1,070,099 / (1 + (12 / 100)) ^1

= 1,070,099 / (1 + 0.12) ^1

= 1,070,099 / 1.12

= Rs.955,445.53

Year 2...

3606382 / (1 + (12 / 100)) ^2

= 3606382 / 1.12^2

= Rs.2,874,985.65

Year 3...

3890477 / (1 + (12 / 100)) ^3

= 3890477 / 1.12^3

= Rs.2,769,164.68

Year 4...

3869731 / (1 + (12 / 100)) ^4

= 3869731 / 1.12^4

=Rs.2,459,284.01

Year 5...

3856422 / (1 + (12 / 100)) ^5

= 3856422 / 1.12^5

=Rs.2,188,237.41

Year 6...

3874477 / (1 + (12 / 100)) ^6

= 3874477 / 1.12^6

=Rs.1,962,930.62Next in order to calculate a figure for net present value or NPV…

We add together the sum of the 6 years discounted cash flows and simply subtract the initial capital cost of investment...

(955,445.53 + 2,874,985.65 + 2,769,164.68 + 2,459,284.01 + 2,188,237.41 + 1,962,930.62) - 12,577,000

= 13,210,047.91 - 12,577,000

= Rs.633,047.91 NPV (net present value)Now for the benefit cost ratio (i.e. the weighting of the proposed poultry farming project benefits or profits vs. the initial capital cost of investment)…

We take the NPV and divide it by the total capital cost of start-up:

633,047.91 / 12,577,000

= 0.05 BCR (Benefit Cost Ratio)But what does this mean exactly? And how will an investor interpret this?

To translate…

the potential benefits (or future cash flows) of this poultry farming project (offered toward prospective investors) which have been discounted against the prospective gains of alternative investment opportunity offering an annual interest rate of (X)%, and then divided by the capital costs…

The ratio result is how many (whole) times the net discounted returns (potential earnings) of your poultry farming project can absorb the total capital cost.

So what does a BCR of 0.05, really tell us?

The following Investopedia article advises the following on reading BCR:

“…if a project has a BCR that is greater than 1, the project will deliver a positive NPV and will have an internal rate of return (IRR) above the discount rate used in the DCF calculations. This suggests that the NPV of the project’s cash flows outweighs the NPV of the costs, and the project should be considered.

If the BCR is equal to 1, the ratio indicates that the NPV of expected profits equal the costs.

If a project’s BCR is less than 1, the project’s costs outweigh the benefits and it should not be considered.”

Back to our example...

So...

Is Sridhar Gupta and his management team likely to raise commercial investment funding with this layer farming project report?...given the BCR is below 1 at 0.05?The straight answer is: no.

Why?

Because the costs of the project outweigh the potential benefits.

Investors will look for more advantageous opportunities to invest in.

As any investor will tell you, the value of money is either increasing with interest or decreasing as weighed down by inflation and opportunity cost.

To sink financial investment into a poultry farming project with no real prospect of an increase or return on top of your investment after the duration of use or borrowing – would effectively be a waste of your time and resources that could have be better used elsewhere.

So what advice do we have for our ‘would-be’ poultry farming entrepreneurs?

Give up?

Not necessarily.

Just return to the drawing board and re-calibrate.

The problem lies in capital start-up costs.

They are relatively very heavy.

What are the most heavy capital cost items in this example?

...look no further than land and cost of building hen houses.

How can we significantly reduce the capital start-up cost in an attempt to improve BCR?

acquire cheaper land;find lower cost construction for building chicken housing, or acquire cheaper existing house;source cheaper bird feed

Further reading: